DraftKings Reports $770M First Quarter, Cuts Losses Amid Expansion

DK attributed the growth in Q1 2023 to product innovation, decreased promotional spending, and strong customer acquisition and retention.

A major legal sports betting operator is inching toward profitability.

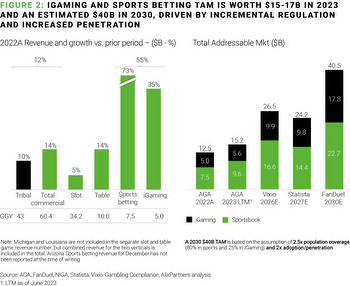

DraftKings generated $770 million in revenue for the first quarter ending March 31, 2023 — an 84% increase year-over-year. The Boston-based company, which offers wagering in Ontario and 23 states across the U.S., reported a monthly average of 2.8 million unique paying customers during the quarter, a 39% uptick compared to Q1 2022.

“Strong execution across the organization is showing up in our results,” said CFO Jason Park.

DraftKings attributed the growth in Q1 2023 to product innovation, decreased promotional spending, and strong customer acquisition and retention. As a result of the strong quarter, DraftKings raised its full-year revenue guidance to range between $3.1 billion and $3.2 billion.

The company previously projected revenue in 2023 to be between $2.85 billion and $3 billion.

Not out of the hole

Despite the jump in revenue, DraftKings continued to report heavy losses. In Q1 2023, the company reported a net loss of $397.1 million and $1.5 billion in cash and cash equivalents. For the same period last year, DraftKings reported a loss of $467.6 million with $2.2 million in cash.

DraftKings’ losses in Q1 2023 were the result of the company continuing to expand its reach and customer base as one of America’s largest online betting sites. On Jan. 1, it launched mobile wagering in Ohio after the Buckeye State awarded online licenses to 16 sportsbooks. On March 10, DraftKings went live with its online sportsbook in Massachusetts — its home state.

Horsin' around

The company followed up its expansion in the U.S. with the debut of DK Horse — a standalone horse racing app that initially launched in 12 states. DK Horse is the byproduct of a multiyear agreement between DraftKings and Churchill Downs that grants access to TwinSpires’ offerings.

“Our goal is to provide our customers with best-in-class sports and gaming products, and we expect DK Horse to provide a fun and new way to engage, said CEO Jason Robins.

DK Horse, which is separate from DraftKings’ sportsbook, is the company’s first foray into horse racing. The app offers pari-mutuel wagering, handicapping tools, and video streams of races.

Growth spurt

DraftKings also plans to further its position in horse racing as it seeks approval for a sports betting license in Kentucky — the Horse Capital of the World. In March, Kentucky lawmakers passed House Bill 551, which legalizes online and retail sports betting in The Bluegrass State.

DraftKings, along with other major U.S. sportsbooks, is expected to be approved for a license.

The company is also doubling down on its entertainment offerings. DraftKings is reportedly preparing to launch a free video streaming service in the coming weeks. DK Network, which will air broadcasts of company-sponsored podcasts, will be financially backed by advertising sales.