DraftKings Stock: A Speculative Bet (NASDAQ:DKNG)

The opportunity in front of DraftKings (NASDAQ:DKNG) is clear. However, it needs to prove that it can get to EBITDA and free cash flow positive and still grow. Until then, DKNG stock is a speculative bet.

Company Profile

DKNG is an online fantasy sports and gambling platform operating in the U.S. It offers sports betting, online casino games, and daily fantasy sports. The company also designs the software to enable these activities.

The company generates revenue by taking in more money in bets than it pays out, which in the gambling industry is commonly referred to as the hold. This is achieved in slightly different ways based on its offerings.

While not always readily apparent, sportsbooks take a cut on the bets they bring in known as the vig and generally aim to have an even amount of action on both sides of the bet, as not to take a side. The sportsbooks create odds and will move the odds in order to try to even out the betting action.

With its online casino, DKNG offers a number of traditional casino games such as blackjack, roulette, baccarat and slot machines, as a well more video game type offerings such a Rocket, where users must cash out of their bets before a rising rocket crashes. Revenue for these game are also generated through the hold. Many games have random number generators associated with them that have a set return to player (RTP) payout, while games like live dealer blackjack have traditional odds built into them favoring the casino.

For daily fantasy sports, the company simply takes in more entry fees than it pays out to the winners. Users play against each other, and DKNG simply takes a cut.

The company operates under the DraftKings name as well as Golden Nugget, following its acquisition last year of Golden Nugget Online Gaming (GNOG).

Opportunities and Risks

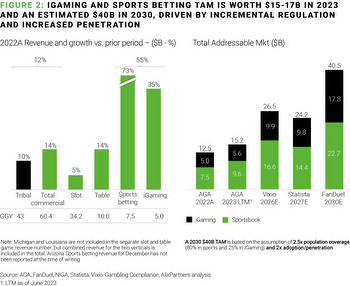

While DKNG is known for its daily fantasy sports offering, its biggest opportunity is in the continued legalization by states of online sports and casino betting.

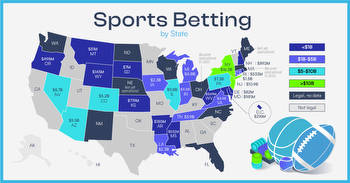

According to the American Gaming Association, 33 states and Washington DC currently have live, legal online sports betting, while 3 have passed legislation making it legal. Eight states, meanwhile, have current ballot initiatives or active legislation looking at the topic.

While many states have legalized online sports betting, there are several very large ones that have not yet taken bets, including California, Texas, and Florida.

In Florida online sports betting legislation has been passed, but it is currently is the courts after the Seminole Tribe claimed that the Indian Gaming Regulatory Act had been violated. In Texas, meanwhile, a bill was introduced in February to legalize online sports betting through a constitutional amendment.

California, for its part, recently rejected two propositions that would have legalized in-person and online sports betting in the state. Local Native American tribes have fiercely opposed online sports betting coming to California in order to protect their casino interests. Interestingly, California is the only state to reject sports betting when it’s been put on a ballot. Online sports betting companies, including DKNG spent money lobbying to get the initiative passed, but it failed miserly, and the state could be the toughest market to get into. That said California is a huge market, and still represents a big potential opportunity.

For its part, DKNG is only active in 20 states, giving it exposure to about 42% of the U.S. population. As such, it has a lot of runway to get into more, plus many states are just recently launched, such as Maryland and Ohio, and take years to ramp up. However, the company has noted that the rate of adoption has been accelerating in each new state it launches in. For example, when it launched in New Jersey several years ago, it took 6 months to get 1.3% of the adult population, while in Ohio it reached 6% of the adult population in under 2 months.

It’s also worth noting that online casino games are currently legal in only six states (NJ, PA, DE, MI, CT, & WV). Illinois and Indiana are expected to launch this year, while Massachusetts is expected to launch within the next two and North Carolina in moving towards legalization.

Mobile is another opportunity, as while 33 states have legal online sports betting, only 22 have legalized mobile sports betting. Massachusetts and Puerto Rico have recently authorized mobile sports betting, and 10 states have introduced legislation. So this too is a tailwind, as people spend much more time of their phones than their computers.

Discussing the opportunity at a Morgan Stanley conference earlier this month, CEO Jason Robins said:

“The U.S. should be the largest online gaming company in the world in due time. It all really depends, since it's getting legalized state-by-state, on how many states legalize sports betting online and iGaming.

"What we've said is that we believe -- at full legalization, you could have roughly an $80 billion market opportunity -- $70 billion or $80 billion market opportunity. And we expect about 65% of the U.S. population to have online sports betting and 30% to have iGaming at maturity. Obviously, maturity, over some reasonable period of time, it could be higher over the long run. So really a big opportunity.

“We think that for DraftKings right now, we're ahead of these numbers. But just being more on the conservative side, we pegged our long-term share at roughly 25% to 30% for sports betting, 15% to 20% -- actually 20% to 25% for iGaming.”

International is another opportunity. While this would be further out given its runway in the U.S., the company did recently enter Ontario, Canada. This is more in the experimental stage as the company doesn’t have the same brand recognition as it does in the U.S.

On the risk side of the equation, the online sports betting arena is facing a lot of competition. Many U.S. casinos operators as well DFS rival FanDuel are all trying to get in on the action. In fact, in DKNG’s 2022 analyst day presentation, they noted there were 23 online sports betting firms that were live in at least 2 states.

As such the company spends a lot of money of sales and marketing for customer acquisition and retention. This comes in the form of not only ads, but also all those free bet offers you see as well as things like odd boosts. And when DraftKings enters a new state, this spending only picks up more.

As a result, the company burns a lot of cash. Including nearly $100 million in cash paid for acquisitions, it burned through over $750 million in cash in 2022.

Valuation

DKNG is not expected to turn EBITDA positive until 2024, when it is forecast to generate a modest $70 million in adjusted EBITDA. Analysts project adjusted EBITDA will increase to $1.1 billion in 2027.

Revenue is forecast to grow 34% this year to $2.99 billion, getting to $5.5 billion in 2027.

The company projects a 28% contribution profit from states in year 3 after launch, which is gross profit less external marketing. With over $750 million in G&A expense in 2022 and another $300 million in tech spending versus only about $170 million in D&A, it seems like it will be difficult for the company to hit that 2027 EBITDA number at that revenue level (even if taking about ~$600 million in stock comp.)

Conclusion

The thesis for DKNG is very straight forward: the company has a huge runway in front of it as more states legalize online sporting betting and online gambling, and it enters these states having a well-known brand because of daily fantasy football.

That said, the company is burning a lot of cash to expand into various states and try to grab as much market share as it can. It has a lot of cash on its balance sheet to fund this currently, and its debt is in the form of a zero-coupon convertible note that was issued when its stock price was much higher than it was today, and thus has an initial conversion price of approximately $94.85 per share.

On its Q3 call, the company projected to have $500 million in cash at the end of 2023, and to be around breakeven in EBITDA in 2024. Based on its Q4 call, it appears that its 2023 EBITDA loss should be less than previously forecast, so its cash on hand at the end of 2023 should be even higher by about $100-150 million.

If the company can get to EBITDA breakeven in 2024 and continue its strong growth, the stock looks interesting from here, although its EBITDA growth targets look aggressive. As such, DKNG stock right now is a speculative bet.