How the New Tax Impacts Gambling in India

India has a developed online gambling market. Many offshore operators exploit it. The government is working on introducing a new tax policy on gambling. This article will analyze the potential impact of new regulations on the best online casinos in India.

The proposed increase of the gambling tax from 18% to 28% rattled the cages of Indian gambling industry. The best online casinos are concerned about the negative impact of this proposal. They are considering leaving the Indian market or altering their services to remain in profit. How the New Tax Impacts Gambling in India.

The proposed tax policy in India includes paying a 28% tax on revenue. It would affect sports betting, horse racing, casino gaming, poker, bingo, fantasy sports, and daily fantasy. Players and operators think the new approach is unfair. Since gambling companies work on specific margins, many businesses might become unprofitable.

The new tax system will apply to online casinos and gambling companies. The new system has many flaws. There are still a lot of discussions to take care of. The authorities will find the right approach to address them all. It is hoped they will not have to change the current system.

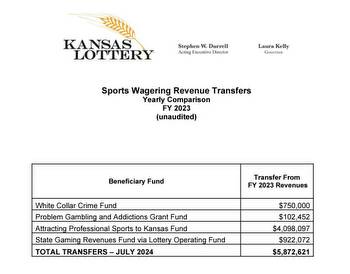

The new law on taxation in India is likely to be accepted in the near future. The new tax model will introduce a lot of dissatisfaction among gambling operators and players. It is questionable whether many operators will manage to avoid losses and eventually fail for bankruptcy. Some reputable operators might leave the Indian gambling market. Online casinos might be pushed out by international operators. Online casino games with a low Return to Player will dominate their portfolios.

Gambling taxes are inevitable. Government can enjoy many benefits from taxing proceeds and investing them in other sectors. However, these drastic measures can disrupt the growing industry.