Industry Insider Says PENN Needs To Use All Of ESPN

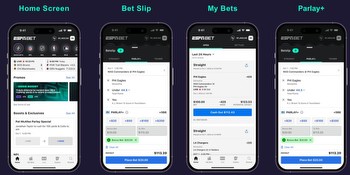

The easy part for PENN Entertainment was signing the 10-year deal with ESPN to rebrand its Barstool Sportsbook into ESPN BET later this year.

The hard part will be hitting 20% market share by 2027, as that’s the goal PENN CEO Jay Snowden laid out during his company’s earnings call this month. Currently, the market is dominated by FanDuel and DraftKings. In fact, those two — and to a lesser extent Caesars, BetMGM, and the current incarnation of Barstool — accounted for more than 92% of the gross gaming revenue for online sportsbooks in the third quarter of 2022, according to numbers compiled by Vixio. Barstool’s share represented a little more than 4% of that number.

Add in Fanatics launching its sportsbook, and it’s clear that achieving 20% market share for ESPN BET is going to be no small feat.

So can it be done? Lloyd Danzig, the managing partner of the New York-based Sharp Alpha Advisors, declined to predict, but he does see a pathway for PENN to make the most of this opportunity.

“PENN will be a winner if they leverage ESPN into something truly unique and differentiated, beyond traditional affiliate marketing activations,” said Danzig, whose company invests in private companies in the sports and gambling world (he holds no position in PENN or Disney, the parent company of ESPN). “Providing ESPN BET account-holders with free access to standalone, direct-to-consumer ESPN offerings or aggregation of premium live sports content is one potential path to meaningful customer acquisition at scale.”

In an email interview, Danzig suggested to Sports Handle that PENN needs to take advantage of everything ESPN has to offer in an effort to pull customers away from the other operators.

As an example, Danzig pointed to the much-hyped Michael Jordan documentary, The Last Dance, which aired on ESPN in 2020. If something ballyhooed like that were to come out next year, Danzig noted, one way to acquire customers would be to allow early access for users of the ESPN BET app.

“ESPN is a one-of-a-kind asset that should be uniquely leveraged to acquire and retain ESPN BET users,” Danzig said.

PENN agrees, without specifics

Snowden touched on such possibilities during the earnings call earlier this month, although he didn’t get into specifics.

“… Our relationship with ESPN will allow us to create deep media integration that will provide highly efficient customer acquisition as well as increased engagement, loyalty and friction-free access to betting on the sports teams, players, and events they love,” Snowden said.

And in a statement to Sports Handle, Mike Morrison, the vice president of sports betting and fantasy for ESPN, doubled down.

“ESPN BET will provide a strong combination of product and scale that will be unmatched in the marketplace,” Morrison said. “Powered by PENN Entertainment, ESPN BET will attract fans through a personalized and streamlined sports betting experience that will capitalize on the incredible reach, value and trust the ESPN brand offers.”

Danzig sees a plethora of opportunities inside of Snowden’s and Morrison’s words.

“Possible activations include integrated watch-and-bet functionality, free access for depositors to ESPN+ and any future direct-to-consumer content offerings, betting alerts delivered through the ESPN app, unique on-field VIP experiences, an integrated rewards program across all of ESPN’s current and future business lines, bet types inspired by and integrated into popular ESPN shows, and celebrity-led betting-focused broadcasts,” Danzig said.

Again, Snowden briefly touched on the broad outline of some of these topics during the earnings call. (PENN declined to comment to Sports Handle on any future plans for ESPN BET, pointing instead to Snowden’s comments on the earnings call.)

“We are particularly excited about the level of integration ESPN BET will have in the broader ESPN ecosystem,” Snowden said. “With 105 million-plus monthly unique digital visitors, an audience of more than 370 million across social platforms, over 25 million ESPN+ subscribers, and the nation’s number one fantasy database, ESPN has unparalleled reach within the world of sports.”

66 million vs. 105 million

If this sounds vaguely familiar, well … consider Snowden’s similar after the now-abandoned partnership with Barstool Sports was announced: “In addition, with 66 million monthly unique visitors, we believe the significant reach of Barstool Sports and loyalty of its audience will lead to meaningful reductions in customer acquisition and promotional costs for our sports betting and online products.”

Granted, “105 million monthly unique digital visitors” is more than “66 million unique visitors,” but getting those people to sign up — and use — ESPN BET to the tune of 20% market share will undoubtedly be a challenge.

Chris Krafick, the managing director for sports betting and emerging verticals for Eilers & Krejcik Gaming, a consulting firm concentrating on the gambling sector, pointed to a note the company put out in the wake of the deal. It estimated ESPN BET’s implied market share — based on PENN’s own estimates — would be between 9% and 18% by 2027.

“While there may be a path to the lower end of the implied market share range, the upper end feels challenging to us,” the note read.

Additionally, Eilers & Krejcik’s analysts don’t see as much gain for the sportsbook from ESPN’s particular version of the “nation’s number one fantasy database.”

“We note ESPN Fantasy’s season-long fantasy focus and believe season-long players, in a vacuum, likely cross-sell to OSB at appreciably lower rates than DFS players,” the note read. “DFS is a proven OSB proxy/form factor; season-long, by contrast, is less betting-infused/betting-forward, with player motivation factors typically more geared toward bragging rights and other social elements (e.g., drafting).”

In the end, everyone will just have to wait and see what PENN is planning with ESPN BET, which is expected to launch as the new brand in November.

“We’ll have a lot more to share with you of how we’re thinking about product road map and enhancements in media integrations between ESPN and ESPN BET and feeds and the other questions you have,” Snowden said near the end of the earnings call.