Queensland law bans gambling companies from claiming tax-free bonus bets. This is what it means for punters

New law in Queensland bans gambling companies from claiming tax-free bonus bets. This is because the money they get from punters is now considered taxable revenue for gambling firms. The law is intended to provide better and more reliable funding for Queensland racing.

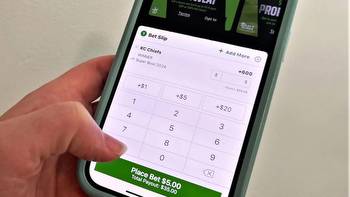

Queensland law bans gambling companies from claiming tax-free bonus bets. Free bets are made-up money that can't be withdrawn from the app or used for anything except making a bet. University of Queensland's director of digital cultures Nicholas Carah says free bets help to get people gambling.

New laws change the calculation of taxable wagering revenue. Free bets will be considered as money received by the company. Betting companies will have to pay a higher tax rate of 20%. 80% of the waggering tax revenue will go to Racing Queensland.

Queensland law bans gambling companies from claiming tax-free bonus bets. Treasurer Cameron Dick says it's to provide a more sustainable funding model for Queensland's racing industry. Responsible Wagering Australia, which represents bet365, Betfair, Entain, Sportsbet, Unibet and Pointsbet says the changes to Queensland laws could result in less-attractive odds.

Queensland law bans gambling companies from claiming tax-free bonus bets. Some providers are planning to scale back the offers in the state. This is because the cost of offering free bets has increased. New national laws also force online bookies to advertise under new taglines. Dr Carah believes there will be a shift in how betting companies advertise. i in this way, they will continue to innovate.