2023 In Review: U.S. Sports Betting Goes Full Tilt

Legal sports betting exploded to unprecedented size and prominence in 2023. Along the way, it claimed some victims while its competitive landscape changed materially.

The topline indicators of the sports wagering business pointed to the robust and expanding market that advocates dreamt of when the U.S. Supreme Court ruled in 2018 to allow states to make their own laws in this area. The American Gaming Association projects that the total sports betting handle for the year will exceed $100 billion. For the January-September period, $78.7 billion has already been recorded. In November, New York set an American state record for monthly handle with a total of $2.1 billion.

On a company level, too, signs of meteoric growth were easily found. DraftKings is set to end the year with its stock value up by more than 220% amid fast-growing revenue, while FanDuel, the American sports betting market leader, is preparing its own U.S. stock market entry.

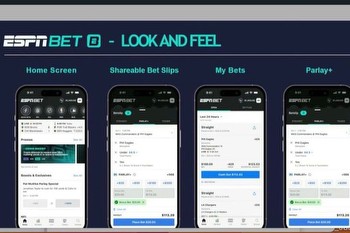

Most dramatically, the biggest brand in sports media, ESPN, finally entered the space through a $2 billion deal with PENN Entertainment. The mid-November debut of ESPN Bet helped fuel

Beginning as a reskinned version of the former Barstool Sportsbook and Casino app, the Disney-PENN strategy for ESPN Bet, in many ways, looks to replicate the seamless integration between sports media and betting seen with PENN’s theScore in Canada, where consumers easily move between reading content and building betting slips.

A key early sign of the now-shifting betting market occurred in Pennsylvania, where PENN turned a sixth-place ranking and a 3.8% market share in October, with the Barstool app, into a third-place position and 7% market share—behind only FanDuel and DraftKings—the following month. Thanks in part to the ESPN Bet rollout, PENN’s handle in the Keystone State more than doubled from $32.3 million in October to $66.8 million in November.

Similar dynamics are emerging in other top markets where ESPN Bet is active, part of a push by PENN to target a much broader pool of consumers than just betting enthusiasts. “One of the things we’ve talked about a lot is we’re seeking to reach sports fans, not just sports bettors,” PENN CEO Jay Snowden said in November at the ESPN Edge Conference.

ESPN and PENN have a highly ambitious goal of achieving a 20% market share position by 2027, a move that would encroach on the current FanDuel-DraftKings duopoly, which currently controls more than 70% of the overall market. (If you include BetMGM and Caesars, the combined market share of that group nears 90%.)

As a result, several smaller entities left the sports betting business altogether, and diminished their presence, or were acquired by other operators. Fox Bet shut down in August, followed by a similar decision in November from Malta-based operator Unibet to leave the North American market, and WynnBet’s marked reduction of its national-level profile to focus on a few key states. Those moves travel a similar path as the demise of MaximBet, Fubo Sportsbook, and Churchill Downs in 2022.

The sports merchandising giant Fanatics, meanwhile, significantly advanced its sports betting ambitions by completing this past summer a $225 million deal to acquire the U.S. operations of PointsBet. The arrival of the Michael Rubin-led company, in addition to the similarly well-resourced ESPN Bet, is further squeezing out smaller players and reshaping the American sports betting market.

“In a lot of states, you can really see the market beginning to center around a top-tier group of players including DraftKings, FanDuel, BetMGM, Caesars, ESPN Bet, Fanatics, and maybe Bet 365,” Dustin Gouker, a sports betting consultant and longtime gaming journalist, tells Front Office Sports. “For so many of the other entities out there, how do you even get to 5% market share? What is the value proposition, and how do you really differentiate? Do you have the resources to compete for consumers? So I think we’ll see more players drop out.”

Also contributing to the consolidating market is the slowing pace of state expansion. North Carolina’s legalization in June led the charge in 2023, though a formal start date for wagering hasn’t yet been finalized, and Vermont is set to begin sports betting in January. Meanwhile, California and Texas, the two most populous states—and therefore industry whales—have thus far shown stiff resistance to legalization.

The Lone Star state in particular won’t formally revisit the issue until at least 2025, when its legislature next meets, though Mark Cuban’s recent deal to sell a majority stake in the Dallas Mavericks is predicated in part on the possibility of building a major casino and arena complex in Dallas.

“Over the last five years, new state launches were a big part of the overall growth trajectory for sports betting,” Gouker says. “That’s going to be less the case going forward, and the growth will be more incremental, certainly until we know what’s going on in California and Texas.”

The explosion of U.S. sports betting was paralleled by a rise in players and coaches breaking league and team rules. In October, the NHL suspended Ottawa Senators forward Shane Pinto for half a season for “activities related to sports wagering,” marking its first modern-day, gambling-related suspension. The NFL, meanwhile, modified its rules in September after the suspension of 10 players this year for gambling violations, seeking to protect the integrity of the league by seriously punishing players for betting on games and betting activity at team facilities.

In college sports, the state of Iowa came down hard on the football and baseball programs at Iowa and Iowa State, eventually securing guilty pleas from five athletes for underage gambling. But it wasn’t just players who found trouble in this area: Alabama fired baseball coach Brad Bohannon in May for suspicious betting activity in a scandal that also led to the resignation of Cincinnati baseball coach Scott Googins.

The issue has grown so critical for the NCAA that new president Charlie Baker began a lobbying effort in October to update state laws and protect student-athletes from sports betting-related harassment and coercion. Those political efforts haven’t received nearly as much public focus and attention as the organization’s maneuverings around name, image, and likeness (NIL) rules. But given that the U.S. sports betting market is nearly 100 times the size of the NIL business, the NCAA’s work here could become a far more impactful endeavor.

It’s just one of several 2024 sports betting subplots that currently leave more questions than answers for the burgeoning industry.