ESPN BET Helped Pennsylvania Set Wagering Record Last Month

The mid-November arrival of ESPN BET on the Pennsylvania sports betting scene helped push the monthly statewide handle over $900 million for the first time, setting the second consecutive record for wagering volume.

The news for PENN Interactive and its rebranded sportsbook wasn’t all positive, however, in the Pennsylvania Gaming Control Board’s November report released Tuesday.

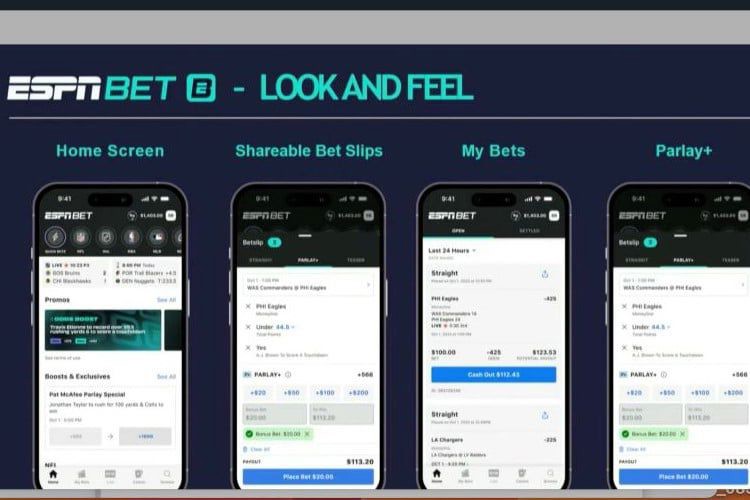

It showed a net monthly loss of $7.8 million for the combination of PENN’s Barstool Sportsbook and ESPN BET, which replaced Barstool on Nov. 14 across 17 states. Combined in Pennsylvania, they took $65.1 million in bets in November, more than double what Barstool saw in October, but ESPN BET also used $14.8 million in promotional credits from bonus offers to lure customers, more than twice as much as its $7 million in gross revenue.

Overall, the 12 online and 18 retail sports betting sites in the state established a new high of $934.1 million in collective handle last month, a 12.7% increase from October, when Pennsylvania sportsbooks exceeded $800 million for the first time. The volume was also an 18.3% increase from November 2022.

November is always among the busiest sports betting months of the year, due to a calendar that brings together a bevy of pro and college football action in addition to a full slate of NHL and NBA wagering.

Bettors do better in some Novembers than others, and while it’s almost impossible for them to collectively beat the sportsbooks, Pennsylvanians did very well last month by keeping operators to a 5.3% hold rate compared to 8.9% a year ago.

That meant the books’ gross revenue totaled $49.1 million, and after adjusting for the $36.3 million in promotional credits led by ESPN BET’s arrival, they had taxable revenue of a modest $12.9 million – the lowest amount since June 2022 despite the record handle. At Pennsylvania’s 36% tax rate, state and local governments took $4.6 million as their share last month.

Also notable was that the November report for Pennsylvania’s volume, combined with one Tuesday from Michigan showing $584.1 million in legal sports betting handle there last month, pushed the total across the U.S. above $100 billion annually for the first time, according to Sports Handle’ssports betting revenue tracker.

PENN sportsbook’s market share doubled

While FanDuel and DraftKings continue to represent more than 70% of betting action in Pennsylvania by themselves, which is common in many states, there has been huge interest in what kind of difference it would make for PENN’s sportsbook to now carry the ESPN brand.

The transition clearly had a big impact, as the operator’s 7.4% share of online statewide handle was twice as much as its 3.7% share in October and also above the 6% of November 2022. The ESPN BET numbers from last month carry uncertainty for the future, however, in that the new platform operated for just half a month after the rebrand and a generous betting bonus offer would have enticed many customers.

Customers who had been with Barstool Sportsbook as well as those completely new to wagering could make use of a generous $200 to $250 in bonus bets as an introduction to ESPN BET. That offer would have represented a large part of the $14.8 million in promotional credits the site gave away.

Typically, FanDuel and DraftKings are far and away the biggest in promotional offers through their sports betting apps, just as they have the highest handle and revenue.

Last month, FanDuel gave away $10.7 million in promos while grossing $19 million in online revenue and $8.4 million in taxable, adjusted revenue from its record $381.9 million in handle. DraftKings provided $6.1 million in promotional credits while earning $13.9 million gross and $7.9 million taxable on $250.6 million in online handle.

The ESPN BET rebrand and welcome offer helped PENN’s site move ahead of customary third-place finisher BetMGM in handle. BetMGM last month took $52.8 million in bets, with $1.7 million in gross revenue but only $2,694 of it taxable after adjustments for its promotions.

Though its volume was also surpassed by ESPN BET in handle, Caesars Sportsbook had a sharp 23.2% increase in wagering from October to reach $45.1 million in bets with gross/taxable revenue of $1.4 million/$0.9 million. That was far better for Caesars than October, when it reported a net loss.

BetRivers took $30.9 million in bets while reporting $1.3 million/$0.3 million in revenue.

The retail side of things

Only about 6% of Pennsylvania’s sports betting last month came in person at casinos and off-track betting parlors, which amounted to $57.4 million of the total. The retail books earned $2.6 million from losing wagers.

The interest in the Philadelphia Eagles, who were having a highly successful season before encountering a December losing streak, would have been a heavy driver of November betting volume. The three busiest retail betting sites were all in southeastern Pennsylvania.

The Rivers Philadelphia casino easily led all retail sites with $13.7 million in handle, following by Parx with $8.4 million, Live! Philadelphia with $8.1 million, and Rivers Pittsburgh with $5.1 million.