Daily on Energy: Galveston senator's plan to use state power to choke off Biden Gulf offshore wind farm

Washington Examiner magazine and get Washington Briefing: politics and policy stories that will keep you up to date with what's going on in Washington.

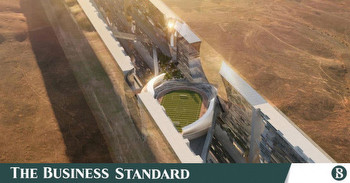

TEXAS STATE SENATOR OUTLINES PLAN TO CUT OFF GULF OFFSHORE WIND PROJECT: A Texas senator is leading the fight to oppose the Biden administration’s first offshore wind sales in the Gulf of Mexico, arguing that the planned sales—which include two separate sites offshore Galveston totaling 199,266 acres—would result in job losses and environmental harm.

Sen. Mayes Middleton of Galveston, a Republican, filed earlier this year, which would implement a state-level permitting process for any offshore wind projects in Texas. It's an attempt to use state powers to stymie the Biden administration's efforts carried out under federal law.

The bill would require the sign-off of all relevant state agencies, as well as a permit from the Texas land commissioner (a post currently occupied by Dawn Buckingham, who she has “serious concerns” about such wind projects).

“This project puts our economy and our national security at risk,” Middleton told the Washington Examiner in an interview.

“It’s very close to Freeport and the Houston Ship Channel, which together represent about 900 billion in economic impact,” he said, citing the most recent estimate from Port Houston authorities. “That's countless jobs.”

Middleton said he plans to re-file the bill as early as this fall during a special session. Others, including environmental groups and commercial fishing groups in the state, have joined in the chorus of opposition.

Hurricanes are also a major concern: Category 4 and 5 storms barrel regularly through the Gulf’s warm waters during the hurricane season.

“You’re talking about turbines that are around 800 feet tall here—they’re huge,” Middleton said. “We don’t know what would happen to these wind turbines during a Category 5 hurricane.”

The lease announcements for the Gulf of Mexico were in pursuit of the Biden administration’s goal of developing 30 GW offshore wind capacity by 2030. And while it is unlikely Middleton will be able to stop the administration from moving ahead with its plans, he is determined to marshal together all state-level agencies and stakeholders to try.

“It’s going to be harmful to Texas if it ever was completed, so we just need to make sure that it doesn't happen,” he said. “There's just no reason for taxpayers to foot the bill for a multibillion dollar offshore wind boondoggle like this.”

Welcome to Daily on Energy, written by Washington Examiner Energy and Environment Writers Breanne Deppisch (@breanne_dep) and Nancy Vu (@NancyVu99). Email [email protected] or [email protected] for tips, suggestions, calendar items, and anything else. If a friend sent this to you and you’d like to sign up, . If signing up doesn’t work, shoot us an email, and we’ll add you to our list.

ENERGY DEPARTMENT DITCHES SPR BUYBACKS AS PRICES CLIMB: The Biden administration to help refill the Strategic Petroleum Reserve, leaving the nation's emergency stockpile at its lowest level in 40 years as oil prices continue to tick higher.

The purchases were part of the administration’s buyback plan aimed at replenishing the reserve after the 180 million barrel oil sales ordered by President Joe Biden last year.

DOE "remains committed to its replenishment strategy for the SPR,” a spokesperson said, which includes direct purchases, returns of oil that loaned to companies following a hurricane or other natural disaster, and the cancellation of planned sales where drawdown is deemed unnecessary, in coordination with Congress.

But the plan to refill the SPR is not going as smoothly as the administration might have hoped.

DOE is hoping to purchase oil to refill the reserves when prices fall between $67 to $72 per barrel—but that’s well below current crude prices, which have seen five straight weeks of gains as global demand rises and Saudi Arabia’s extended supply cuts continue to squeeze markets.

International benchmark Brent crude stood at $84.55 per barrel as of mid-morning today, while futures for WTI were also above the $80 threshold.

In the interim, Energy has come under sharp criticism by Republicans in Congress, who say the SPR levels could pose a national security threat and leave the U.S. resource-strapped in the event of a natural disaster or short-term supply disruption.

NO CHANGE TO OIL OUTPUTS: OPEC+ is unlikely to tweak its current oil output policy when members meet on Friday, Reuters – coming at a time when tighter supplies and strong demand are driving oil prices higher.

Reuters that the committee would probably not make any changes to the existing policy during a scheduled meeting to take place August 4 – with one of them citing the rising oil price as a reason to take no action.

If you’ll recall: UAE Energy Minister Suhail al-Mazrouei said late last month that current actions by OPEC+ to support the oil market were “sufficient” for now, with the group only being a “phone call away” if further steps were needed. However, a surprise can’t be ruled out – it’s still possible that the group could take action even while stating that no further moves are to be expected. Back in April, several OPEC+ members announced further oil output cuts ahead of a Joint Ministerial Monitoring Committee meeting that was expected to take no action.

AVIATION FUEL TAX STRUGGLES: The EU’s plan to start taxing polluting aviation fuels has hit an impasse as member states struggle to agree to make green fuels cheaper and fossil fuels more expensive, Reuters

The group’s 27 member states have been struggling to negotiate an overhaul of energy taxes – which haven’t been updated since 2003 – with their new climate change targets. But two years after the EU executive proposed a law to tax aviation fuels for the first time, a deal is still nowhere to be found.

The proposal at hand: The minimum tax rate for aviation fuel for flights within Europe would gradually increase over 10 years, and sustainable fuels would get a 10-year tax holiday, to increase their use.

The issue causing strife: The bloc’s member countries are at odds over, among other things, whether to introduce an EU-wide minimum tax for such fuels, which currently escape levies. Changing EU tax policy can be difficult because it requires unanimous approval from all member countries – meaning any country can block. And some countries are warning against measures that could raise energy prices for voters before the European Parliament elections next year.

ESCAPING THE CHAMBER (OF COMMERCE): ClimateVoice, an environmental nonprofit organization that works with climate-conscious companies to influence policy-making, is launching a today calling for tech companies to leave the U.S. Chamber of Commerce – a pro-business trade organization whose positions on climate policies

– which website evokes the aesthetic of an ‘90s video game – calls for companies including Amazon, Google, and Microsoft to “escape the chamber,” outlining the group’s history of lobbying against major climate initiatives.

“Pro-climate companies have the opportunity to leave the Chamber and lead the way with strong advocacy for climate policy,” the campaign reads. “And now’s the time — we need to defend the Inflation Reduction Act (IRA) and pass new climate policies to have a chance at curbing the potentially catastrophic effects of climate change.”

The effort is the latest move by the group to scrutinize the industry’s climate initiatives – and involves a petition drive urging its corporate members to leave the trade group.

DRAX’S POWER PLAY: UK Power company Drax Group PLC was in a position to blunt consumers’ energy costs during the region’s energy crisis – but managed to avoid returning hundreds of millions to consumers as electricity prices skyrocketed last year, according to a Bloomberg News

According to the report, a generator at the firm’s power plant had received £1.4 billion ($1.8 billion) in green-energy subsidies from consumers – with the goal of this public aid to ensure that it was profitable for Drax to fuel the unit with biomass, an alternative renewable energy source. This method came with a safeguard, however: If electricity prices ever increased enough that Drax’s generator could comfortably make a profit without subsidies, its earnings would be capped, and the company would have to send any extra cash back to customers.

Only, that didn’t happen. As household energy bills began skyrocketing, the company slashed production at the unit that was required to cap its earnings – and used others that weren’t – which allowed Drax to avoid sending consumers an estimated £639 million as of July. Meanwhile, the company sold some of its biomass pellets at high prices on the open market.

DOE POURS SOLAR DOLLARS TO PUERTO RICO: The Department of Energy announced yesterday that it will be from the Puerto Rico Energy Resilience Fund to increase residential rooftop solar cells and battery storage installations across the region in an attempt to modernize the territory’s electric grid, while focusing on supporting low income residents.

The allocation will be deployed in two rounds of funding, with the first round aimed at incentivizing the installation of 30,000-40,000 solar cells and battery storage systems for low-income, single-family households in areas with frequent and prolonged outages. Families with a member who has an energy-dependent disability, such as an electric wheelchair or individuals who use at-home dialysis machines, can also qualify. Potential applicants can also include private industry, non-profit organizations, energy cooperatives, educational institutions, and state and local government entities.

Some background: The PR-ERF was established in last year’s omnibus appropriations bill, which included $1 billion to enhance energy resilience for the territory’s vulnerable populations, and help the Commonwealth meet its goal of 100 percent renewable energy by 2050.

The Rundown

Iran declares public holiday over ‘unprecedented’ heat wave risk

UAE promises to allow climate protests at COP28

Are EV sales really slowing down? What experts are saying.