Transocean: "The Iron Law Of Electricity" (NYSE:RIG)

Transocean (NYSE:RIG) has been a favorite of mine for about a year. The company's stock rose after its Q3 earnings. I wrote a detailed thesis for the company in September. In this article, I discuss the central thesis as to why this will occur. I also discuss strategic thoughts about oil supplies in the coming years.

The Saudi war on U.S. shale made drilling uneconomic. The rise of the ESG 'oil is bad' movement killed offshore drilling. Countries and companies shifted their focus to renewables. 3/4 of a trillion dollars has been deferred from exploration and development since 2015. The wind in the North Sea didn't blow. Interest in acquiring new sources of petroleum and natural gas surged. RIG has dodged debt bomb after debtbomb over the years. It is trying to avoid the asset liquidation. Transocean is a company that follows the "Iron Law of Electricity".

RIG has the largest fleet of high spec 6-7th generation rigs that will command premium pricing. RIG is in a better position to field these rigs than its closest competitors. Noble Corp. and Valaris have restructured and have balance sheet advantages to Rig. Valaris and NE trade at dangerous EPS multiples. On an absolute basis Rigs is $4.00 per share. It is the only OSD whose stock hasn't gone to zero in the last seven years. It's a numbers game and Rigg's stockholders have not been completely wiped out.

This was another quarter of incremental improvement in dayrates and the contracting environment.

The offshore drilling market is recovering. Offshore CapEx budgets of the majors have increased for the second consecutive year.

Drillship day rates have moved above the $400,000 per day mark. RIG added $1.6 billion in backlog since the July fleet status report. The new 8th Gen rigs, the Atlas and the Titan are contracted for the next 2-5 years at acceptable rates. Brazil has a new leader, Lula, who is a big advocate for Petrobras. Norway is going through a soft patch with day rate in the mid-$300s.

Drillship day rates have recently moved above the $400,000 per day mark. RIG added $1.6 billion in backlog since the release of the July fleet status report. The new 8th generation rigs, the Atlas and the Titan are contracted for the next 2-5 years at acceptable rates. Brazil has a new leader, Lula, who is a big advocate for Petrobras.

RIG reported a net loss attributable to controlling interest of $28 million in the third quarter. They generated adjusted EBITDA of $268 million and improved the adjusted profit margin to 37%. Revenues above guidance came from higher uptime rates and an early termination fee. Operating and maintenance expense for the quarter was $411 million. RIG ended the 3rd quarter with total liquidity of approximately $2.1 billion. They expect adjusted contract revenue of between $600 million to $1.9 billion for 2023.

There is a real expectation that sometime in the next year a contract will be signed at a day rate above $500K per day.

Dayrates for ultra-deepwater drillships have improved 113%. Transocean expects the trend to continue.

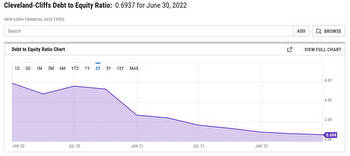

RIG owes $6.5 billion in debt. The big ones are due in 2026, 2027 and 2028. They will be paid when due.

There is a risk of shareholder dilution, but it's not the end of the world. Day rates will gradually increase over the next 1-2 years. There is also the risk that there will be a shortage of petroleum.

Absent any material increase in the trading price of shares, the company does not plan to utilize its ATM equity sales program in near future.

The EU is on the verge of de-industrialization. The effects will be felt in output, employment and GDP. Prior to the advent of the ESG movement, the focus on energy was making sure we had enough of it and it was as cheap as possible.

Europe's industrial companies are saving energy. Demand for natural gas and electricity fell in the past quarter. The drop is due to companies turning down thermostats and shutting down plants.

There is a potential dislocation of energy in the Western World. It will have a profound effect on attitudes about drilling for oil and gas. The Iron Law of Electricity will kick in. There will be bidding contests for drilling fixtures.

Transocean is a top pick because of potential for EBITDA expansion. The company is on track to turn in $1.2-$1 bn in EBTDA over the next year. If the average day rate hits the $401K/day they list in the FSR, the Ebitda would drop to $2.0 bN. To maintain a 7X multiple, shares would need to rerate toward $8.00.