Joe Montana, VC Funds Participate In Sports Betting Exchange Novig’s Seed Round

As undergraduates at Harvard University, Jacob Fortinsky and Kelechi Ukah became friends, bonding over their shared experiences and passions, including playing in poker games. Still, they never thought they would end up working together in a gambling capacity, as they now are as co-founders of Novig, a nascent sports betting exchange that’s scheduled to launch in its first state (Colorado) in October and recently secured $6.4 million in a seed funding round.

Fortinsky studied philosophy, political science and economics and had experience working in legal research and investment banking. He took the LSAT and planned on going to law school or earning his PhD.

Ukah, meanwhile, majored in physics and math and took a year off from school during COVID-19 to work as a fellow at CERN, the European Organization for Nuclear Research. He also had an internship at Jane Street, a famed quantitative trading firm. He was debating whether to work as a trader on Wall Street or become a physics professor and researcher.

Those plans are now on hold, perhaps permanently, because Fortinsky and Ukah saw an opportunity to make an impact in the booming sports betting market in the U.S. and beyond. Numerous investors agree, at least based on the money Fortinsky and Ukah have raised, even though almost all of the legal sports betting in the U.S. is done through sportsbooks rather than exchanges.

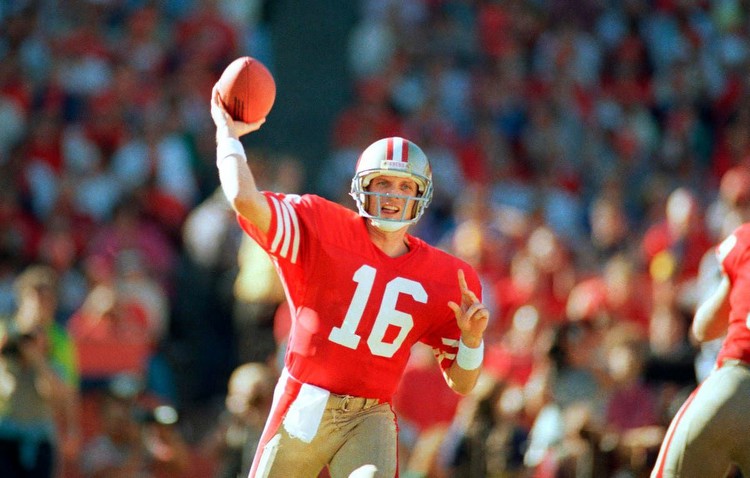

Lux Capital led Novig’s seed round, while several other venture capital firms participated, as did Y Combinator, Pro Football Hall of Famer Joe Montana and famed startup investor Paul Graham. Fortinsky said the company raised money at a weighted average post-money valuation of about $33 million.

“I think a lot of founders are desperately looking for a company to start and always knew they wanted to start companies,” Fortinsky said. “But for us, the idea fell in our laps. We felt like we would regret it for the rest of our lives if we didn't pursue this.”

Fortinsky launched the company in March 2021 during his second-to-last semester at Harvard, while Ukah joined that fall during his senior year after completing his summer internship at Jane Street. The company raised a pre-seed round of $800,000 in February 2022 from two VC firms (Lux Capital and Innospark Ventures) and a number of angel investors and then went through a Y Combinator program last summer.

Fortinsky was a prolific sports bettor, but he said he was disappointed using traditional sportsbooks such as FanDuel or DraftKings because they have a “vig,” which is a fee/commission they charge for using the app. Fortinsky claimed that he was nonetheless making money betting on sports, but the traditional sportsbooks limited the amount people like him could wager.

“It felt very inefficient, outdated, exploitative,” he said. “The number one reason why people stop sports betting or don’t start sports betting is there’s a fundamental understanding that the house always wins. The game is sort of rigged against the everyday bettor. You're just a pawn in their game, effectively. I felt like there's a lot of opportunity to create a more fair, transparent and efficient system.”

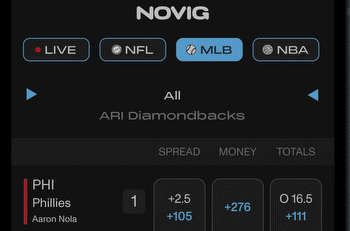

Fortinsky and Ukah have modeled Novig after a stock exchange like the Nasdaq or an online marketplace like Ebay, where people can buy and sell with each other rather than rely on a third-party to set the price.

In Europe, sports betting exchanges such as Betfair are popular, but that’s not the case in the U.S., where sportsbooks that set the odds dominate. The first sports betting exchanges in the U.S., Prophet and Sporttrade, launched last September in New Jersey.

Unlike other betting exchanges, Novig will not charge any fees to almost all bettors, but there will be small fees for those whose net winnings are greater than $10,000, according to Fortinsky. The company hopes to attract high-frequency traders on its platform, though, and does not want to limit the amount of money those groups can bet.

Novig recently had a beta test of its exchange for 200 users over a two-week period, where 15,500 orders were placed. The company claims it can instantly confirm live bets, whereas sportsbooks can take up to 80 seconds to approve a bet.

For now, the main issue is making Novig available to bettors, which can be a slow and challenging process because the company must get approval from each state and strike a partnership with a land-based casino in each state to operate. As of now, the company only has approval to operate in one state, Colorado, which is set to begin in mid-October with NFL, NBA and Major League Baseball betting.

Novig plans on applying for licenses in other states in the coming months, including New Jersey and Ohio. If all goes well, it will then expand to other countries in the next 24 to 30 months, according to Fortinsky, who would like to get into other sectors besides sports, too.

“This is really a prediction market for sports,” Fortinsky said. “But, fundamentally, there’s nothing different about sports markets than other markets, whether that’s esports or chess or politics or whatever. We have to see what is feasible from a regulatory perspective, but we’re very excited to expand into a number of different verticals, as well.”