Law: Rules and Regulations Regarding the Sports Betting Industry in Colorado

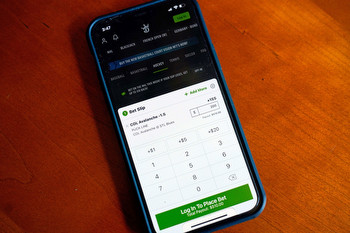

The sports betting industry in Colorado is regulated by the Colorado Limited Gaming Control Commission. The commission has established a number of rules and regulations that must be followed by all sportsbooks where you can place sports bets, such as betting on basketball with odds to win March Madness, operating within the state. These rules and regulations cover various aspects of the industry, such as licensing requirements, taxes, advertising restrictions, customer protection measures and more. Let’s explore them.

What are the legal age requirements for sports betting in Colorado?

The legal age requirement for sports betting in Colorado is 21 years old. All individuals wishing to place bets on sports must be at least 21 years of age and have a valid form of identification. All online sportsbooks require customers to provide proof of identity before they can begin placing bets to ensure that only those legally allowed to bet on sports are doing so.

Applicants must provide detailed information about their business operations, including financial records and background checks on employees. They are also required to pay an annual fee of $50,000 for each location where they offer services. And as far as sportsbooks are concerned, to operate legally in Colorado, they must obtain a license from the Gaming Control Commission.

Are there any restrictions on what types of bets can be placed in Colorado?

Of course, the answer is – yes; there are restrictions on what types of bets can be placed in Colorado. All sports betting must take place at a licensed retail or online sportsbook. Bets must be placed on professional and collegiate sporting events, and no wagers may be placed on high school sporting events. On top of that, all bets must be made with real money; no virtual currency is allowed. The state does not allow any type of proposition bets (bets that involve predicting the outcome of an event that is not related to sports).

What taxes are associated with sports betting in Colorado?

In Colorado, sports betting is subject to a 10% tax on the net proceeds of all bets placed. This means that for every $100 wagered, the operator must pay $10 in taxes. The state also imposes a 3.2% sales tax on all wagers placed at retail locations and online sportsbooks and an excise tax of 0.25% on all bets placed at retail sites and online sportsbooks in Colorado. All taxes collected from sports betting are used to fund various programs throughout the state, including education and infrastructure projects.

Sportsbooks are also subject to taxation based on their gross gaming revenue (GGR). Taxes range from 6% for online wagers to 10% for retail wagers. In addition to these taxes, operators must also pay a 2% state fee on GGR that is used to fund problem gambling programs in the state, as with any other fee in the state, for that matter.