Everything To Know About The Massachusetts Sports Betting Launch: What Can The Bay State Learn From Ohio?

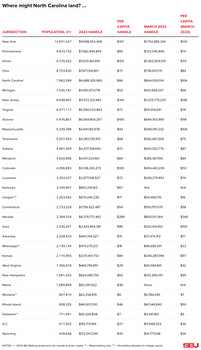

Sports betting continues to expand across the United States, with Ohio having launched on January 1, Massachusetts retail shops opening on January 31, and online sports betting in Massachusetts is expected to begin just ahead of March Madness. Betting on professional sports and college games will be permitted; however, in-state college betting will not be allowed unless the team is playing in a tournament.

With Massachusetts mobile sports betting eyeing an early March debut, we look back at Ohio’s launch and consider several factors to better understand what to expect for online wagering in the Bay State.

Massachusetts will begin with retail sports betting for at least one month before launching online sports betting. Retail sportsbooks are being operated only at the state’s three casinos - Encore Boston Harbor, MGM Springfield, and Plainridge Park - so initially, residents will be limited in betting options. However, in early March the floodgates will open with the launch of 11 online sports betting apps. Operators, including BetMGM, Caesars Sportsbook, WynnBET, and home-grown brand DraftKings, have received licenses from the Massachusetts Gaming Commission. That differs significantly from Ohio, which launched retail and online on the same day, so the initial results from both states should differ drastically.

The Buckeye State saw 15 operators launch in January. Massachusetts bettors will see many of the same sites, with the exception of SuperBook, Tipico, bet365, and Ohio local BetJack. One item of note is that Massachusetts is the birthplace of DraftKings and Barstool, providing those companies with what we believe is a massive home-field advantage.

Deutsche Bank has estimated the total gross sales revenue in Massachusetts for 2023 to be approximately $306.6 million. In an On the Record interview by NewsCenter 5 in Massachusetts, Treasurer Deb Goldberg said she estimates the state’s betting industry to generate between $35 and $50 million annually in tax revenue.

In Ohio, where record revenue has been generated, total gross sales revenue for 2023 is expected to be between $700 million and $1 billion, generating between$70 and $100 million in tax revenue for the state.

It’s worth noting, the Commonwealth also has the advantage of a higher average household income than Ohio at around $90,000 compared to around $62,000, despite a lower population of 7 million vs. 12 million.

Max Bichsel, Vice President at BetMassachusetts.com, explains that he believes Massachusetts will be competitive in terms of revenue produced from online sports betting primarily due to its reasonable tax rate, which has proved to be successful in other states.

“Massachusetts' tax rate of 20% is competitive among states currently offering regulated online sports betting. I believe that this fair and commensurate rate will allow sportsbooks in the Commonwealth to thrive.”

“In 2022, Arizona’s 24% tax rate generated $582 million in revenue for the state, from $7.2 billion in total wagers.” Bichsel added that “all indications suggest Massachusetts will be equally, if not more, successful as states with similar tax regimes.”

Historically, states with major league sports teams have benefited from higher sports betting revenue. For example, New York, Michigan and Indiana have each averaged $668 million in betting revenue annually, while West Virginia and Connecticut (neither of which has major league sports teams) averaged around $70 million.

Massachusetts is home to five major league sports teams, including five-time Super Bowl champions the New England Patriots. With that in mind, you can expect the Bay State to be on the higher end of revenue projections.

With all that revenue being generated, who are the beneficiaries? In Ohio, sports betting revenue is taxed at 10 percent, which is on the lower side when compared to most other sports betting states, with proceeds from the taxes primarily going to the General Revenue Fund for schools, with 2 percent addressing problem gambling and addiction, and 0.50 percent of license fees going to a veterans' fund. In Massachusetts, taxes are a little higher at 20 percent for online and 15 percent for retail. Tax proceeds will be divided into several buckets:

- 45 percent to the General Fund

- 27.5 percent to the Gaming Local Aid Fund

- 17.5 percent to the Workforce Investment Trust Fund

- 9 percent to the Public Health Trust Fund

- 1 percent to the Youth Development and Achievement Fund

We cannot forget about regulations, which can impact sports betting markets for better or worse. Regulations have been a hot topic recently, particularly for these two nascent sports betting markets. Ohio was one of the first states to strictly enforce its regulations by fining Caesars, DraftKings, and BetMGM $150,000 each for running advertisements in violation of both Ohio law and administrative rules relating to advertising and promotions. Additionally, Ohio gaming regulators are enforcing no use of the words “risk-free” or “free bets” in gambling advertisements. We expect Massachusetts to follow suit in the regulatory area as the Massachusetts Gaming Commission is already widely regarded as the top regulator within the industry.