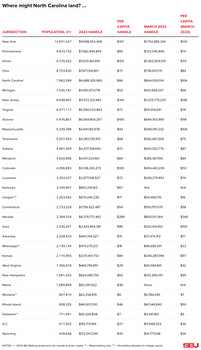

North Carolina Sports Betting: Where Will The Tax Money Go?

Eight operators in North Carolina are on track to have their mobile betting apps licensed in the Tar Heel state when wagering begins.

North Carolina becomes the 30 state with online sports betting. The state law that allows sports betting includes a provision that will tax the gross gaming revenue of each sportsbook at 18%.

Estimates vary on just how much revenue sports betting will generate for the state. The figure depends on how many sportsbooks eventually launch in the state and how well will those over 21 are eligible will embrace legal, online betting.

The Fiscal Research Division of the North Carolina General Assembly has projected that legal online sports betting could generate $64.6 million in taxes during its first full year, eventually growing to $100.6 million by its fourth year.

Where Does The Sports Betting Revenue Go In North Carolina

The bill (HB 347) that enabled sports betting in North Carolina was signed into law by Gov. Roy Cooper on June 12, 2023. It outlines how the revenue from sports betting will be spent by the state.

Once a handful of benchmarks are met, 50% of the tax revenue generated by online sports betting in North Carolina will go to the state’s general fund. Another 30% will go to the North Carolina Major Events, Games, and Attractions Fund. That group promotes regional and national events in the state. The final remaining 20% will go to 13 schools (listed below) to support their athletic departments.

Off the top, the initial revenues will be directed toward specific services and entities.

Here is a breakdown:

$2 million: Responsible Gaming

The North Carolina Department of Health and Human Services will receive money to fund programs for the treatment of gaming addiction, counseling, the promotion of responsible gaming programs, outreach, and other initiatives

$1 million: Youth Amateur Athletics

The non-profit organization North Carolina Amateur Sports has the goal of “promoting health and wellness for all ages and skill levels.” It will receive this money through a state grant specifically directed to buy equipment and/or upgrade facilities for youth sports.

$1 million: North Carolina Youth Outdoor Engagement Commission

This is allotted for teams who are traveling out of state for athletic competitions. The law allows up to $5,000 per grant, per team. It also allows up to $25,000 to be spent on promoting and attracting various state, regional, and national sporting events.

$300,000: 13 State Universities

There are 13 universities whose athletic departments will get $300,000 each initially from sports betting revenues. They include five Historically Black Colleges and Universities (HCBU). Those 13 schools are:

- Appalachian State University

- East Carolina University

- Elizabeth City State University (HBCU)

- Fayetteville State University (HBCU)

- North Carolina Agricultural & Technical State University (HBCU)

- North Carolina Central University (HBCU)

- University of North Carolina - Asheville

- University of North Carolina - Charlotte

- University of North Carolina - Greensboro

- University of North Carolina - Pembroke

- University of North Carolina - Wilmington

- Western Carolina University

- Winston-Salem State University (HCBU)

These same schools will then split 20% of the remaining revenue as noted above.

Paying Taxes On Gambling Winnings In North Carolina

Yes, you will owe taxes on your sports betting winnings in North Carolina.

All money earned from sports betting is taxable income. And in terms of taxes, it is treated in the same way as any other. Thus, it could well impact both what you pay in federal and state income taxes.

The IRS allows you to deduct gambling losses up to the amount of your winnings only if you itemize all your deductions. Therefore, it’s important to keep detailed records of the money you wager, what you win, and lose. You may be better off taking the standard deduction or itemizing once you run the numbers.

Your federal tax rate will depend upon which bracket you fall into once your Federal Adjusted Gross Income (AGI) is calculated.

If you itemize your federal deductions, your net gambling winnings will be added to your AGI. If you take the standard deduction, all of your gambling winnings will be added to your AGI.

In North Carolina, whatever gambling winnings used in your AGI are subject to the state income tax of 5.25%.

If you take the standard federal deduction, enter your gambling winnings in the “Other Income” spot on Line 8 of the IRS 1040 form. That figure is used in determining your overall federal AGI. North Carolina residents who file a D-400 tax form report their federal AGI on Line 6.

Customers should receive a W2G from each legal online sportsbook with whom they wager if their overall winnings are more than $600 or they win on a bet that pays 300-1 or higher. You are responsible when it comes to reporting your income, whether or not you receive this form.

As always, you should consult a tax professional or financial advisor to see how your individual situation is affected.

Different Rules In Tennessee, Virginia, Kentucky

Each state that has allowed legal sports betting since the Supreme Court opened the door for nationwide wagering in 2018 has different rates and methods of taxation for its sports betting revenue.

Three states that border North Carolina: Virginia, Kentucky, and Tennessee currently offer legal online wagering. The other two states, Georgia, and South Carolina are considering it.

In January, the Georgia State Senate passed a bill that would legalize sports betting with the approval of a constitutional amendment. South Carolina lawmakers are also considering sports betting legislation.

Tennessee

sports betting is taxed based on the overall handle of each sports book regardless of their net winnings. Tennessee is the only state with legal online sports betting that taxes it in this manner. There, operators pay 1.85% of their overall handle to the state. Of that money, 80% goes toward funding education. 15% goes to local governments, and 5% is allotted to mental health programs.

In January, Tennessee’s Sports Wagering Council reported the state’s handle was $465.8 million and the tax assessment totaled $8,596,621.

All sports betting in Tennessee is online. Since betting launched on November 1, 2020, the state’s handle has surpassed $11.185 billion. The state has collected $196.354 million in taxes off an adjusted gross revenue number of $1.097 billion.

Kentucky

Retail and online sports betting launched in this past September after House Bill 551 became law. The Sports Wagering Excise Tax is 9.75% in Kentucky is for retail sportsbooks and 14.25% for online books. That number is based on the adjusted gross revenues of each operator.

As of early December 2023, the most recent figures available, the state generated more than $656 million in overall handle between its retail and online books. Combined since the September launch, the books had paid more than $8 million in taxes.

Most of the money collected by the Commonwealth will be directed into its pension system. A small amount is held back to fund the Kentucky Horse Racing Commission’s costs to regulate sports betting. A percentage of the revenue is directed toward programs to fight problem gaming and promote responsible gaming.

Virginia

Sports betting launched in in January of 2021. Operators pay a 15% tax rate on their adjusted gross revenues. Adjusted gross revenue is the difference between the overall handle and the total winnings paid to patrons, the federal excise tax of 0.25, and incentive promotions and bonuses paid to customers.

Overall 97.5% of the tax collected goes into the Commonwealth’s general fund and 2.5% is deposited into the Problem Gambling Treatment and Support Fund.

Since sports betting launched, more than $143.92 million has been paid to the state in taxes. Overall the state’s handle has been $13.674 billion, and operators have enjoyed a hold of 6.95%, or more than $950.96 million.