SBJ Betting: Different sports, different impact

I like mailbags. The best ones are driven by questions that make you think: “Hey, I was wondering that, too.”So for the first SBJ Betting mailbag, I solicited questions from four of our beat writers; people who I know are curious -- because that’s part of the job -- and plugged in on what those around the sport that they cover are asking about when the topic of sports betting comes up.

If you have sports betting questions of your own -- about the industry, not about whether the Jets will cover in their preseason opener -- send them along and maybe we’ll include the best of them in a reader-generated mailbag in a future newsletter.

With that, let’s get to their questions. Big thanks to our Ben Fischer, Tom Friend, Erik Bacharach and Adam Stern for playing along. Your tumblers engraved with “I sent SBJ Betting a question and all I got was this crappy cup” are in the mail.

Show me numbers

What evidence is there so far that legal sports betting has actually increased fan engagement in sports, i.e., a benefit aside from sponsorship/media fees? -- Ben Fischer, SBJ football writer

This is one Ben and I have volleyed for almost as long as there has been legal sports betting outside Nevada.

All the leagues say they’ve seen increased engagement, which typically would be defined by increased viewership -- or a slowed decline of viewership -- for games and shoulder programming. Network execs often concur. At last count, there have been eleventy-seven surveys showing that people are more likely to watch a game when they have money riding on it.

Shocking, I know.

But that’s a survey, not a measure. And it doesn’t account for whether fans are simply betting on the games they’d be watching anyway or watching the same volume as they did before, when they were betting illegally or tracking their daily fantasy entries.

It’s logical to assume there is more betting now than there was when it was illegal, and that betting begets a deeper level of interest; that fans will stay tuned to the end to see whether a team covers the spread or a player reaches his total on a prop, tacking minutes on to average duration; that an otherwise mundane "Monday Night Football" game would be a more likely watch when you’ve placed an after-dinner wager on it.

It all makes sense.

But what about empirical evidence? If you have any, please send it along. We’d like to share it.

When did the script flip on Vegas?

Assuming the A's end up in Las Vegas, the NBA will be the last Big 4 league without a team in Sin City. But with expansion looming -- and Vegas a prime candidate to receive an NBA franchise -- any stigma of putting a pro team in the betting capital of the world is finally over. How and why did the landscape change? What are the main reasons leagues finally gave in? -- Tom Friend, SBJ basketball writer

There are a couple of things at play here, Tom.

The first is that I’m not sure that the existence of casinos is what kept the leagues from putting teams in Vegas -- at least not alone. I think it was more about whether the economic base of the market, beyond tourism, was sufficient to support a team. The NHL took that gamble, the Golden Knights proved the concept, and now the question is no longer whether Vegas can support a team, but how many it can support. I think that’s where you start.

Then, as the Golden Knights were on their way to an otherworldly Stanley Cup Final appearance in their first season, the Supreme Court struck down PASPA, the federal law that kept states other than Nevada from legalizing sports betting. Not only did the leagues see that Vegas could support a pro team, they knew legal sports wagering was about to make its way across the country. And that online sports betting would offer commercial opportunities that didn’t exist when fans had to walk in to a sportsbook or drive to a kiosk to place a bet.

When people ask why the leagues spun 180 degrees on sports betting after decades of fierce opposition, I hold up my iPhone. Leagues and teams saw no upside from sports betting when wagers were placed at a casino. They make lots of money from sponsorships and data rights now that fans in legalized states can bet from home, or their seat at a game, or anywhere else.

Leagues would have gotten past any stigma that was holding them back from Vegas whether PASPA had fallen or not. The growth of the city alone would have fueled that. But having it happen during the same year that an expansion hockey team was selling out T-Mobile Arena night after night probably sped things along.

Are shorter MLB games affecting bets?

With MLB game times down about 26 minutes this year thanks to the advent of the pitch clock, are fewer bets being placed on baseball? It stands to reason that less game time means a smaller volume of wagers, but I’m curious if sports betting is following the same pattern as in-venue per-caps -- that is, despite the shorter games, concession, merchandise and alcohol sales at the ballpark have remained flat. -- Erik Bacharach, SBJ baseball writer

Good question, Erik. Let’s dig into the spreadsheet that has come to dominate my waking hours and see what we can find.

We’re going to be limited on sample size, since only six states break betting handle out by sport in their monthly reports and only four of those are online betting states that were also operating at this time last year. But we do have results from two months of baseball in Illinois and Colorado -- home to the Cubs, White Sox and Rockies -- and three months in Indiana and Oregon that we can consider.

To adjust for increases and decreases in overall activity, we’ll look at baseball as a percentage of all handle.

In Illinois, baseball handle in April was $156.8 million, up a stout 22% over the same month last year. It went from accounting for 15% of all handle to 17% of handle. In May, it was $173.9 million, even with last May. As a percentage of all handle, baseball fell from 23% for the month last year to 21% this year.

We’ll call Illinois a wash.

The story is similar in Colorado. Baseball betting was up 27% in Colorado from April of last year to this year, while overall betting in the state rose 7%. It went from being 18% of all betting to 21%. It swung back in May, though, dropping from 25% of handle last year to 24% this year.

Another wash.

Three months of Indiana numbers look similar to Illinois and Colorado. At the season’s start, baseball betting was up 8% compared to last April while overall handle fell 10%. As a percent of handle, it rose from 16% to 19%. Then, in May, it dropped back to even as a percent of handle at 23%. In June, it fell precipitously, going from 33% of handle at $84.5 million to 29% at $65 million. If either the April rise or June fall were tied to game time, you would think they’d be headed in the same direction.

In Oregon, which does not allow betting on college sports, baseball betting is up 32% over last season through three months. But, it’s only slightly outpacing the overall market, which has grown 28% for those three months. In May, it accounted for 41% of all handle -- identical to last May.

With those four states as the barometer -- and they make for a fair one, with Illinois, Colorado and Indiana ranked as the No. 2 , No. 10 and No. 13 markets, respectively -- I’d say the rule changes have had no appreciable impact on betting, or at least betting volume.

The problem here is that the way people bet on baseball is changing at the same time as the game is speeding up. It has increasingly become about player props and same-game parlays that casual bettors and fantasy players have embraced. Sped up play would have little impact on those. So this could be the case of the rise of one masking any impact from the other.

Pretty good chance we’ll be digging into this more as the season winds down.

Are bettors finding motorsports or combat sports?

Are people betting on boxing right now like they used to? And Is there any incremental improvement in share for NASCAR or F1 in the betting market? -- Adam Stern, SBJ motorsports and combat sports writer

Adam, you’re a good dude and a dedicated beat reporter. I wish I could take the motorsports and combat properties through the same paces as baseball. Unfortunately, they make up such a small percentage of handle that only Illinois and Colorado tell us anything about them.

In Illinois, boxing and MMA are grouped together and typically combine for 1% of handle. It fluctuates based on the interest level on fights in a given month. This past April was relatively busy, with handle coming in at $14.5 million, up 45% from the same month last year. In May, it was back down to $8.5 million.

Colorado gives us a better idea of how UFC and boxing compare, at least in that state.

UFC performs more consistently than boxing, which pops for a big fight but withers between them. In April, boxing handle was $2.1 million. The previous April, it generated so little it was lumped into “other”. It was around $1 million in May of each of the last two years. Most months, UFC generates double or triple the handle of boxing in Colorado. In April and May of the last two years, it ranged from $2.6 million to $4.9 million.

Only Illinois breaks out motorsports betting. In May, which includes the Memorial Day weekend marathon of F1 in Monaco, the Indy 500 and NASCAR's Coke 600, handle for the sport was $1.4 million, down from $1.6 million last year. Motorsports accounted for 0.2% of handle for the month. Illinois does not break out betting by sanctioning body, so we can’t compare NASCAR to IndyCar or F1.

NASCAR has worked hard to build a betting product and expose fans to in-race wagering. But it has a lot of ground to make up in a crowded universe. It, and the fight promoters, will have to create compelling betting offerings and educate fans on what they are for that needle to move.

That’s going to do it for our first mailbag. If you’ve got a question you wouldn’t mind seeing in print, send it along and maybe we’ll include it in a future dispatch.

NFL educates players, coaches and staff about betting policies

At in-person sessions that she expects her department to lead for more than 20 teams this summer, NFL Chief Compliance Officer Sabrina Perel has walked players, coaches and staff through a 30-minute review of the league’s policy on sports betting.She began with the well-known, long-standing prohibition of betting on NFL games, working her way down to more nuanced policies, such as one that allows players to place legal bets on other sports, so long as it’s not from the workplace, which includes stadiums, training facilities and hotels while on the road for a game.

Perel also covered rules that apply to coaches and other team and league employees, who are barred from betting on any sport, from anywhere, ever. “We’ve had questions everywhere, from rookies and from veterans,” Perel said. “And that’s the great part of it.”

SBJ Live to tackle latest trends in sports betting

Next week, I’ll be hosting the latest installment of our interactive show SBJ Live, with a terrific panel scheduled to include Chris Grove, sports betting investor and Eilers & Krejcik partner, and Eric Foote, the former PointsBet chief strategy officer who recently hung out his shingle as proprietor of the consultancy Vig Sports.

We’ll cover a range of topics and take some questions. If you haven’t signed up for the session, which convenes at 12:30 ET on Thursday, July 26, you can do so here.

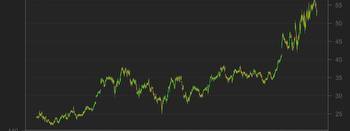

Summer swoon continues for handles

We’ll keep you up to date with state handle results as regulators file reports throughout the summer, but you can expect the story to be the same each month until we get through August. Steady decline, and then the paddles come out when football kicks off.

Clear!

One thing worth noting: Continued year-over-year declines in states that border more recently legalized states. Those first-mover advantages in New Jersey, Indiana, D.C. and New Hampshire were real, but they weren’t sustainable.

NOTES: Arizona regulators have not yet reported April results.

- Sports betting is a big potential growth area for ESPN, and my colleague John Ourand cited sources bringing up the possibility of DraftKings, FanDuel, Flutter or MGM as possible investors in ESPN. But those sources were divided. The skeptics pointed out that even as Disney's Bob Iger has warmed to the idea of cutting sports gambling deals, it still represents a leap for Disney to sell a stake in ESPN. Other sources disagreed, maintaining that sports gambling represents one of ESPN’s biggest growth opportunities.

- The Arizona Department of Gaming will "award three new event wagering licenses" -- two to sports franchises and one for a tribe, reports the Arizona Republic.

- The NCAA "has found 175 infractions of its sports-betting policy since 2018 and there are 17 active investigations," notes the AP.