The White House: Going global with your portfolio using the difference between truth and fact

Lessep IM's portfolio manager James White shares his insights into the global economy. LesseP IM runs a core portfolio of 40-50 stocks that go for opportunities in productivity trends and reflect investments in both the drivers and beneficiaries of said trends. James also aims to run a long-tail of stocks with the potential to capture a greater share of new or existing markets.

The distinction between fact and truth is at the heart of alpha* generation's investment challenge.

The White House explains the difference between truth and fact. Alpha is the value with which we can measure an investment portfolio’s excess return (performance) against a particular benchmark.

The NRL Grand Final between Penrith Panthers and Parramatta Eels was expected. Penririth won the game. Parratta's team lacked midfield penetration, outside strike power and genuine pace on the flanks. The 2022 NRL grand final attracted 2.76 million domestic viewers on Australian free-to-air broadcaster (FTA) Channel Nine.

The Lessep portfolio is constructed to reflect the difference between truth and fact. The best long-term returns will be associated with positions where the sense of the truth runs ahead of available facts.

Lessep's portfolio position was at odds with the facts that were important to the market. The market saw peaking Chinese property sales as a lead indicator for weaker iron ore demand. LesseP's position has been rewarded in early 2019.

Today's portfolio reflects a world where the sense of truth is not justified by fact. Lessep portfolio has few positions where truth and facts align. In most positions, the market has arrived at the conclusion that the facts point to difficult times.

It's been a monster for equities. Every other asset class has fallen. Equities are likely to be among the best performing asset classes at some point in this cycle. This may be because central banks ease monetary policy. It may reflect a combination of valuations reaching their new equilibrium and companies exhibiting pricing power.

When Money Dies is a book about the Weimar Germany's economic collapse and the rise of inflation. Ed finds it intellectually satisfying and emotionally traumatic. It is also a warning against the addictive dangers of printing money. It deals with the human side of the inflation and its dark, long-term legacy.

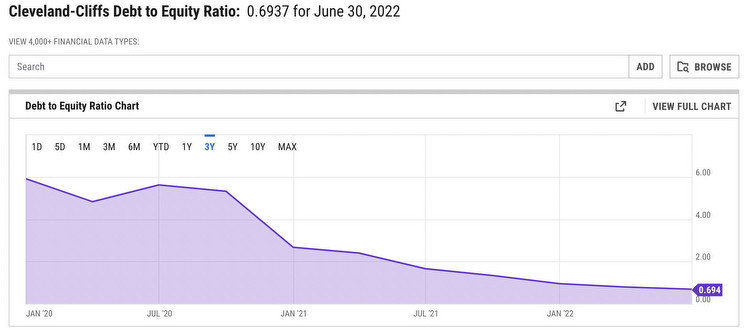

The quality of large global equity assets has improved dramatically over the last decade. The airlines, semiconductor equipment maker KLAC and heavy machinery company Caterpillar are among the most indebted. Cleveland Cliffs Debt to Equity has fallen from 5.9x to 0.69x since 2019.

2022 has been a tough year to run a long-only global equity portfolio. Nestle performed well in 2022, but when the market does turn, the upside for the stock is limited. The de-composition of stock returns through 2023 and 2024 is likely to be weighted towards sales and earnings, rather than valuations. Valuations have found a new equilibrium as a consequence of higher interest rates. Those companies able to grow in this environment will be those that exhibit the best returns.