What the Dallas Mavericks sale means for John Fisher and the Oakland Athletics

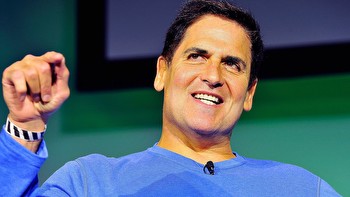

Dallas Mavericks owner Mark Cuban is reportedly selling a majority stake ($) in his NBA franchise to Miriam Adelson and her family, one of the largest casino magnates in the world, for $3.5 billion. How does this news relate to the Oakland Athletics, you ask?

It’s interesting to see the line continue to blur between professional sports and sports betting. As we know, Las Vegas is one of the largest gambling centers in the country. The Vegas strip is filled with casinos and sports books where consumers spend millions of dollars each day.

A league that once banned Pete Rose for life now has a partnership with FanDuel, a leading online sports betting site, and is currently working with the Athletics to build a new ballpark on the site of an existing casino.

It’s highly likely that we’ll eventually get some sort of gambling suite or sports book built into a stadium, potentially the Athletics’ new facility, where fans can watch a live game and place sports bets in the same facility.

Texas has fairly strict regulations around gambling so it’s not worth holding your breath to see how the Adelson family approaches integrating sports betting into the Mavericks operations.

It is interesting, however, to see how sports franchise valuations have changed over time. Values have increased across the board in all sports, baseball included. Basketball values are skyrocketing though.

Just two years ago in 2021, Steve Ballmer bought the LA Clippers for $2 billion. Earlier this year, Mat Ishbia bought the Phoenix Suns for upwards of $4 billion. Now, the Adelson family has purchased a controlling stake in the Mavericks for $3.5 billion.

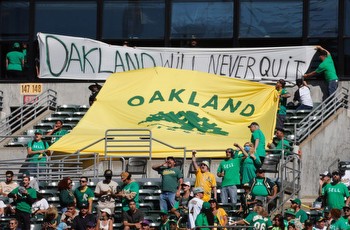

Prior to the NY Mets sale, Forbes had the franchise valued at $2.9 billion. They ended up selling to Steve Cohen for $2.4 billion, still a significant price. Forbes has the Athletics valued at $2 billion. If John Fisher wanted to, he could get a significant cash windfall and simply walk away.

But there’s plenty of evidence that won’t happen. Plus, we have the fact that MLB has levied a “sell tax” on Fisher that would force the A’s owner to give back a substantial portion of the total if he were to sell in a certain timeframe after the team moves to Las Vegas.

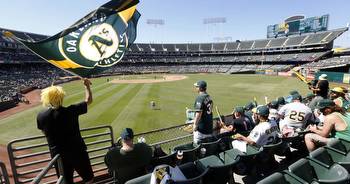

The problem Fisher would run into if he actually did want to sell is obvious – the team doesn’t have a ballpark. The Coliseum site is badly in need of repairs and an honest assessment is that the A’s need a new park. It would be preferrable for A's fans if that park were in Oakland, but it seems increasingly unlikely that the team sticks around.

One more interesting note about the Mavericks sale: despite selling the majority of his shares, Cuban is going to stick around to run the basketball operations department. It seems to be that he enjoys the day-to-day operations aspect, but has chosen to opt-out of the financial risk of owning the team.

Having purchased the organization back in 2000 for just $285 million, Cuban will add a hefty sum to his portfolio. It’s certainly curious to see him choose to sell though.

Part of me wonders whether we’ll see similar activity on the MLB side, considering the RSN nightmare some teams are going through. MLB owners have had it good for a long time. However, losing the constant stream of local television money might be a breaking point for some owners.

The NBA has centralized revenues, the majority of which come from their national television deal. MLB teams receive roughly $50 million annually from the national television contract, but many teams earn much more than that via local broadcast rights deals. The Dodgers in particular pull in over $250 million annually.

It's going to be fascinating to watch how the broadcast rights contracts evolve in MLB over the next 5-10 years, and how the effects of that trickle into baseball operations for teams and owners.