Drance: Bo Horvat trade return is underwhelming. At least it looks to the future

The Canucks’ now-former captain was dealt on Monday afternoon to the New York Islanders for Aatu Räty, Anthony Beauvillier and a conditional first-round draft pick. The club retained 25 percent of his remaining salary, according to Islanders general manager Lou Lamoriello.

Horvat leaves the only franchise he’s ever played for as the 10th leading scorer in Canucks history.

Let it never be said that Horvat gave the Canucks organization anything less than everything that could’ve possibly been asked of him over his lengthy tenure with the club.

He raised his game when the moment called for it. It too rarely did.

He carried himself with a level of professionalism and polish that puts him very much in the same sentence as players like Henrik and Daniel Sedin, Roberto Luongo and Chris Tanev.

He worked diligently to improve himself as a goal scorer, leader and person — and he succeeded.

The Canucks will be worse without Horvat on the ice, and his absence will be sorely felt off of it. Nobody ever said that “major surgery” wasn’t invasive.

Horvat’s departure, however, became an inevitability over the course of the past 12 months. Back in the spring, the Canucks organization was intent on turning the team over to him, on solidifying Horvat as the face of the franchise with a long-term deal.

Despite the best intentions of both sides, Vancouver’s offers didn’t appeal sufficiently to Horvat and his camp. The deal never got done when negotiations got down to brass tacks back in August.

Frustrated, the club turned instead to J.T. Miller, signing the veteran winger to an eight-year, $56 million contract.

From that point on, a split between the Canucks and Horvat was only a matter of time, although the likelihood became a certainty over the course of this season. That’s because Horvat went absolutely nuclear as a goal scorer and priced himself out of Vancouver’s comfort zone entirely with his contract-year performance.

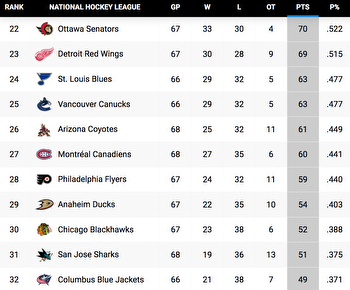

On Monday it was announced that Horvat was on his way to Belmont to join an Islanders team that, in truth, has struggled mightily since qualifying for the Eastern Conference final in consecutive seasons in 2020 and 2021. Since the start of the 2021-22 campaign, both the Canucks and the Islanders have played over 130 contests, and they rank 19th and 20th among all NHL teams by point percentage.

That’s the essential frame through which this trade has to be viewed. Because the Canucks have effectively bought a massive short position on an Islanders team that’s aging, has limited cap flexibility and hasn’t been altogether that impressive despite receiving elite-level goaltending over the past two years.

It’s tempting to look at Beauvillier and Räty as the centrepieces of this trade. Active NHL-level players feel like more tangible assets, after all.

Beauvillier is a middle-six winger making just a shade more than $4 million on a contract that extends through this season and next. Beauvillier is fine. He’s a better hockey player than his boxcar statistics indicate, he’s useful in transition, sometimes brings a high work rate and can responsibly complement skilled players up the lineup, or add some offensive punch to a third line. He’s also been widely available for nearly free on the trade market dating back to this past offseason.

The club is even more heavily invested on the wings in the wake of acquiring Beauvillier, and ideally, you’d have liked to see them take back less in the way of non-expiring salary commitments in a Horvat trade. That said, the deal isn’t long-term, Beauvillier should bring additional value as a rental next season, and in the flat cap NHL it’s nigh impossible to complete a trade of this magnitude without taking back a commitment of this kind.

Räty, meanwhile, is an athletic, large 20-year-old centre who was once thought of as a potential generational prospect. He was historically productive at the ages of 15 and 16 but struggled in his draft-eligible season and fell to the second round — even the Canucks passed on him to select Danila Klimovich in the 2020 NHL Entry Draft.

Overall, Räty is viewed as a very safe bet to have a lengthy NHL career and is capable of being dropped onto the Canucks’ NHL roster immediately. There are some concerns about his skating, however, and he isn’t widely viewed as a player who’s a lock to stick at centre, or as a player with star-level upside.

Beauvillier and Räty have names and faces, which make them seem like the centrepieces of this trade. In contrast, a “conditional first-round pick” is like the mystery box in “Family Guy.” It could be anything. It could even be Beauvillier and Räty.

The upside, however, of that conditional pick is paramount to this deal. It’s the best, highest upside asset that the Canucks have returned in this trade by some margin. Arguably it’s the best, highest upside asset that the Canucks have returned in any trade since acquiring the pick that became Horvat at the 2013 NHL Entry Draft.

That upside, however, is uncertain. It’s a conditional first-rounder, is top-12 protected for the 2023 NHL Entry Draft and will convert to a 2024 first-round pick unprotected if it falls among the top-12 selections at the NHL Entry Draft in Nashville this June, our colleague Pierre LeBrun reports.

So it’s a pick that could fall in the late first round in a few months, which would still be useful given the depth and quality of the 2023 draft class.

It could be even more than that though, particularly if the Islanders continue to sputter despite adding Horvat. If the Islanders are passed in the standings by the Florida Panthers and fended off by the likes of the Washington Capitals, Buffalo Sabres and Pittsburgh Penguins in the Eastern Conference playoff race, there’s a chance the pick could convert to a 2024 first rounder. And if it converts, then there’s no protections on the pick whatsoever.

The Islanders aren’t especially likely to completely bottom out in 2024. Goaltender Ilya Sorokin is incredible and incredibly durable, New York’s blue-line group is legitimate and there’s some solid talent up front in Mat Barzal and Horvat. Stranger things have happened, however, and there’s another blue-chip Vancouver-born prospect looming at the apex of the 2024 NHL Draft class.

That there’s a possibility that the draft pick acquired for Horvat could pay off as a game-changing asset for the Canucks, makes this a justifiable bet for an organization that’s come under fire repeatedly — and with justification — over the past few months. In trading Horvat, the club has at least landed an asset with a chance, although there are admittedly long odds involved, to fundamentally alter their franchise trajectory.

That’s the sort of upside that the club needed to deliver in a Horvat trade.

That they’ve done so through a draft pick, rather than through player assets, makes the return seem underwhelming. Honestly, there’s an argument that the return is still underwhelming. Is the Horvat return even better than what the Islanders paid up for J.G. Pageau in 2020?

Ultimately, this is what rolling the dice on the future of a franchise looks like. These are the sorts of agonizing, difficult decisions that are required to lead a middling team with no cap space, few prospects and very little in terms of asset value out of a decade of darkness. The issue isn’t what the club returned for Horvat, it’s that they haven’t made this type of trade with nearly the frequency that the franchise has required over the past decade.

Jim Rutherford and Patrik Allvin may not have landed the loudest, most exciting possible package for Horvat. Instead, they’ve landed a useful albeit distressed asset, an intriguing young forward and they’ve placed a shrewd long-shot bet against a middling team not altogether that different from their own.

It’s a package that won’t get fans excited on first blush, but honestly, at least it’s consistent with the sort of long-view direction this franchise needs to be disciplined about charting in every move they make if they’re going to get this turned around.