Record Promo Offers Boosted Pennsylvanians' Betting Last Month

The onslaught of full football action in September brings with it a prominent boost in betting activity each year, and last month the mobile sportsbook operators in Pennsylvania did all they could to encourage it.

The statewide $726.3 million in September sports betting handle reported Wednesday by the Pennsylvania Gaming Control Board was buoyed by a record $29.5 million in promotional credits awarded to new and existing customers in the form of bonuses, odds boosts, or other enticements.

The betting volume was 12.6% above the September 2022 level and a whopping 84.8% more than what was wagered in August, before much football was being played.

The resulting revenue was $66.1 million overall among the online and retail operators, with just $36.6 million of it taxable after allowed deductions for the promo credits given by mobile sites. The gross revenue equated to a 9.1% hold rate by the sportsbooks representing what they retained from losing bets.

Pennsylvania’s relatively high 36% tax rate on sportsbook revenue brought $12.5 million to state and local governments for the month.

FanDuel back on top by all measures

In the ongoing battle between FanDuel and DraftKings for supremacy, a lead that DraftKings took in revenue in August proved temporary.

FanDuel reported $253.3 million in September betting handle, with $29.9 million in gross revenue and $18.9 million in adjusted, taxable revenue after credits.

DraftKings was much closer in handle of $228.2 million than it was in revenue of $19.9 million gross and $8.4 million taxable.

Between them, the two betting behemoths represented 71.5% of the online betting handle among 12 sites that were operating in September. They also claimed 81% of the online gross revenue and offered 76.6% of the promotional credits.

BetMGM took its customary position in third place in the state in handle, at $52.4 million, as well as revenue of $4.8 million gross/$1.5 million adjusted.

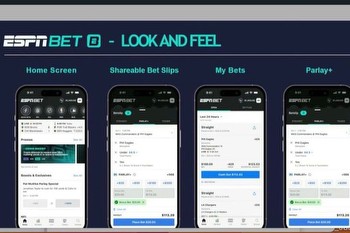

PENN Entertainment’s Barstool Sportsbook meanwhile, stood out for the wrong reasons. It is unusual for the state’s larger operators to be beaten overall by bettors in a month, but it reported a loss of $874,568 on $37.7 million in handle, while giving out virtually no promotional credits. PENN is in the process of rebranding its site as ESPN BET, which is expected to be completed and unveiled next month.

Among other mobile operators of substantial size, Caesars Sportsbook reported $31.1 million in handle, with $1.9/$1.1 million in revenue. BetRivers took $26 million in bets, with $2.3/$1.3 million revenue.

Among operators that handle far less action, September was a bad month for Betway, which showed a gross revenue loss of $7,626, and Wind Creek/Betfred, with a loss of $6,202.

Retail sportsbooks doubled August’s handle

While mobile sportsbooks saw huge month-to-month growth in activity, it was even more the case for retail sportsbooks that attract football fans and bettors to watch games in a unique environment throughout the fall.

While the $53.4 million in in-person betting was still only 7% of the overall total, it was more than double the activity the 19 retail sportsbooks at casinos and OTBs saw in August. They retained $4.6 million in revenue in September from the wagers.

The Philadelphia casinos continued to be the hub of in-person betting, with the September success of both the Eagles and Phillies undoubtedly helping.

Rivers Philadelphia took more action than any casino sportsbook in the state last month, with $8.7 million in handle, followed by Parx Casino with $7.7 million and Live! Philadelphia with $6.7 million. Rivers Pittsburgh saw the biggest handle elsewhere in the state, with $5.5 million.

On the downside, two retail sportsbooks reported revenue losses for the month: Harrah’s Philadelphia at minus $385,644 and the Parx at Malvern OTB at a much smaller loss of $4,663.