FanDuel Makes Much-Anticipated NYSE Debut

American investors now have a direct way to invest in the market share leader in sports betting, setting up yet another market battle between FanDuel and DraftKings.

Shares in FanDuel parent Flutter Entertainment began trading Monday on the New York Stock Exchange, as scheduled, and closed the first day of trading up 0.24%, retreating from gains earlier in the day, at $205.50.

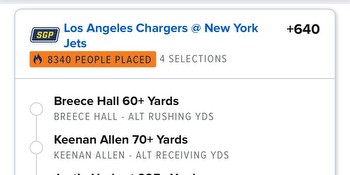

Beyond the continued status as the industry’s largest operator, the Ireland-based Flutter recently said that its full-year 2023 revenue rose by 25% to $12.1 billion, and that it captured 43% of gross U.S. sports betting revenue in the critical October-December period, a stretch that included the heart of the NFL and college football seasons, MLB playoffs, and start of the current NBA and NHL seasons.

Flutter has now initiated further efforts to move its primary stock listing from London to this new issue in New York. The U.S. market debut also arrives shortly before Super Bowl LVIII on Feb. 11, a game expected to set company records for betting handle.

“We believe a U.S. primary listing is the natural home for Flutter given FanDuel’s No. 1 position in the U.S., a market which we expect to contribute the largest proportion of profits in the near future,” said Peter Jackson, Flutter’s CEO.

FanDuel’s chief rival, DraftKings, is also publicly traded and has been since 2020, and those shares have risen in value by more than 167% over the past 12 months and more than 18% so far this year—rebounding from a prior major decline in 2022—as the sports betting market has continued to expand. Because of that market expansion, initial analyst ratings on Flutter are generally strong, and a lift is also projected for DraftKings shares. To that end, DraftKings stock rose 3.7% on Monday to $39.91 per share, easily beating the Flutter increase.