Online betting growth poses risks for teens

At this very moment, sports fans are a few seconds and a few clicks away from turning $10 into $200 on any sports betting app.

Considering FanDuel spent more than $1 billion on marketing last year, this is no secret – but it is a relatively new phenomenon as more states legalize gambling across the country.

Yet, although the legal gambling industry is booming like never before, an illegal market still exists. Globally, illegal sports bets add up to $1.7 trillion each year, according to a report from the U.N. Office on Drugs and Crime.

“It’s the same thing as when the drinking age was increased from 18 to 21 a couple of decades ago,” said Taylor Neil, Pickwise social media manager. “There is still underage drinking, people are going to find ways to get alcohol, the same as sports betting. It’s not an issue you can necessarily solve.”

Sportsbooks have partnerships with every major sports league and gambling content has found its way into legacy media on traditional platforms, such as TV and websites, along with social media.

Whether or not all sports fans embrace betting, sportsbooks and odds have become increasingly prevalent in modern sports media.

From commercials to X promotions or even mid-broadcast sponsorship announcements, consuming sports without at least a hint of gambling-related content is seemingly impossible these days.

“It’s everywhere in terms of the media space,” Neil said. “Likely because people realized there is so much money involved and everyone wants a piece of that pie. It’s pretty much inescapable.”

Due to this rise in popularity and acceptance within the media, sports betting companies are bringing in more users and money than ever.

The global sports betting market accounted for $83.65 billion in 2022 and is expected to expand at an annual rate of 10.3% from 2023 to 2030, according to Grandview Research.

In terms of user participation, the numbers are off the charts as well. Sports bettors legally wagered $310 million in June 2018 while that number hit $7 billion in October 2021 – a 20-fold increase – according to Bloomberg.

Age restrictions, however, limit who can bet.

In the United States, only 33 states and the District of Columbia have legal, operational sports betting. In those states, the minimum legal age to place a wager ranges from 18 to 21.

Despite the presence of illegality in 17 states, content such as ESPN Bet Live, gambling lines presented on the scoreboard, and even social media platforms like X and TikTok can be consumed nationwide.

No matter the fan, what they do, or their location, sports gambling has become increasingly accessible.

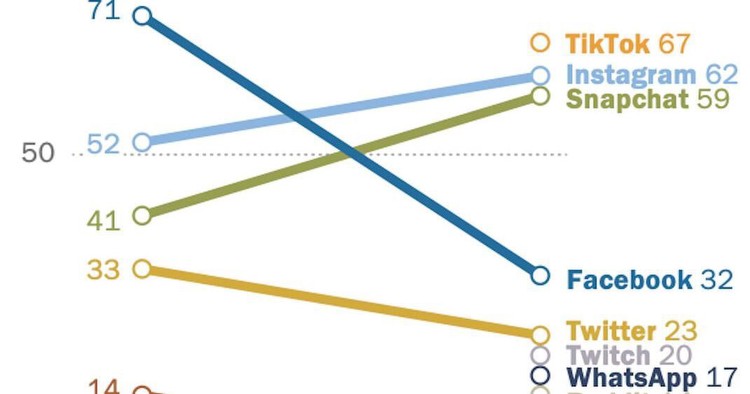

TikTok has become the focus for sportsbooks and betting companies alike.

A Pew Research study said 67% of individuals ages 13-17 say they regularly use TikTok – more than any other social media platform aside from YouTube.

Furthermore, TikTok’s primary age demographic of 10-to-19-year-olds accounts for 32.5% of all users, according to Wallaroo media, surpassing Instagram as the social media platform with the most Gen Z users.

The majority of this demographic does not fit the age minimum required to legally gamble on sports in the U.S., even if located in a legal state.

One might think the legal issues would be enough to turn unqualified users away, but the $1.7 trillion in illegal wagers last year suggests otherwise to some degree.

Sports betting as a whole has become so widely popular that there are several full-time content creators making a living working with sportsbooks and other gambling companies to monetize the large following they have built.

Matt Tanner, known as MattyBetss on social media platforms, is one of these influencers. With over 200,000 followers across all of his social media platforms, Tanner has partnerships with PrizePicks, BetOpenly, Pikkit Sports and BetUS Sportsbook – all of which are sports gambling companies.

Tanner’s content library is primarily made up of light-hearted videos that allow the audience to live vicariously through his personal wagers rather than direct gambling advice, attracting a new audience to sports betting while maintaining a space for existing bettors.

“I wouldn’t say it directly influences me, but I will admit that seeing a guy like Matty throw some coin on an underdog in March Madness for example, might make me want to place that same bet,” Neil said.

With the majority of Tanner’s content published on TikTok comes the reality of minors viewing content beyond his control. Tanner said he has never targeted a specific demographic but recognizes a younger audience could potentially be consuming his content.

Between 60% to 80% of high school students have participated in gambling for money at least once in the past year, according to the International Centre for Youth Gambling Problems and High-Risk Behaviors.

While there are some slight measures parents can take to limit what their child might see on a platform like TikTok – limiting screen time, muting notifications, prioritizing a new “STEM Feed” focused on educational content for the account – it is difficult to eliminate a situation where an underage user might be viewing content like Tanner’s.

“It’s bringing in new eyes and a different style of content that you see working on social media platforms that are geared towards the younger generation,” Neil said. “With that, naturally, you are going to have users probably under the legal age of gambling seeing their content just naturally due to the algorithm.”

Although TikTok has a creator fund that compensates users for well-performing videos, the money is not enough to pay the bills. Instead, creators like Tanner rely on partnerships and affiliate marketing to earn their paychecks.

Affiliate marketing is an arrangement where the promoter, or affiliate, receives a commission on the traffic they generate while the consumer is awarded some sort of sale, bonus or gift in return.

Although influencers aren’t directly commanding their audience to sign up for a gambling company, the problem arises when companies indirectly target the younger, impressionable demographic on social media in order to receive more user sign-ups.

A recent example comes from the online gambling company Sportsbet, which targeted young female users on TikTok during Super Bowl week.

Direct gambling promotions are banned, according to TikTok’s community guidelines, but the social media company allowed Sportsbet to target Australian users as part of a strictly controlled trial.

In this trial, which took place in the days leading up to Super Bowl 57, Sportsbet promoted a video in which a young woman brings attention to the novelty prop bets available for Rihanna’s halftime performance.

In this context, a prop bet market would allow people to bet on what outfit Rihanna would wear, what song she would perform first, or even how many total songs she would sing.

Although it does not directly encourage this audience of young women to gamble, it goes to show the lengths some sports gambling companies are willing to go to grow their user base.

“I wouldn’t necessarily say companies are targeting the young, but the way some of the information is presented, like a game rather than a gamble, I can see how that could cause trouble,” Neil said.

Luke Brennaman, known as BrennyLocks on social media platforms, attributes social media as one of the many effects of the rise in sports gambling’s relevancy, but not the direct cause.

“For the majority of people that do it (sports bet), I don’t think it’s necessarily social media that directly gets them in it, but they see it on social media and then it takes one of their friends doing it to hook them up,” Brennaman said.

Legal, mainstream gambling outlets such as FanDuel and DraftKings have a strict, no underage gambling policy that includes ID checks and social security confirmation in order to avoid anyone finding a loophole.

This issue of age is the primary reason FanDuel is one of the few major sportsbooks yet to sign a partnership with a collegiate athletics program. In contrast, offshore companies such as BetUS Sportsbook and Bovada, however, do not abide by the same guidelines.

BetUS notes in its terms and conditions, “In playing on the BetUS Website you are declaring to us that you are 18 years old or older. If the age limit for gambling in your country is greater than 18 years you declare that you are greater than the minimum age. Minors are not permitted to play at BetUS.”

In other terms, there is no age verification but rather an honor code that individuals will be honest about their age.

The middle ground between traditional and offshore sportsbooks is Daily Fantasy Sports. Even in states where the legal age to gamble on sports is over 21, the age minimum is dropped to 18 for DFS.

While still a form of gambling, DFS is a relatively new phenomenon where users can wager on player statistics and individual performances rather than whole-game outcomes.

DFS companies such as Prizepicks require users to complete an age-verification process via submitting a photo ID, but the requirements are not nearly as thorough as running a social security number like FanDuel and DraftKings.

This middle ground is where many long-time bettors like Tanner believe kids are being introduced to betting due to the ease of access.

“They have guidelines and laws for a reason, and you shouldn’t lower those,” Tanner said. “If you have to be 18 to play DFS, maybe some 16-year-olds are going to do it. If you lower it, we have to wonder, are there 12-year-olds playing DFS and 15-year-olds with a sportsbook account?”

“All these sportsbooks are in the position where they don’t need underage customers,” Brennaman said. “For startups like Prizepicks, like a Thrive Fantasy, like all these apps that are player-prop parlays but they get categorized under DFS. They’re not going to go out of their way to crack down on you.”

While the majority of mentioned companies are transparent about company operations and public data, the concern for parents comes further down the line. If all sports gambling platforms were organized in tiers, here is a rough estimate of what that would look like:

Tier 1: Legal Sportsbooks – FanDuel, DraftKings, Caesars, BetMGM, etc.

Tier 2: DFS – Prizepicks, Underdog Fantasy, Betr

Tier 3: Offshore Sportsbooks – BetUS, Bovada, BetOnline

The further down the tier list a bettor goes, the less likely they are to encounter any sort of age restrictions.

As time passes and more states begin to legalize sports betting, these offshore betting sites are having to compete against major corporations with a far superior marketing budget and legal team. As a result, offshore platforms are less likely to pursue action against underage users as they are desperate to grow their userbase.

Despite major sportsbooks having legitimate hoops to jump through in order to breach the age requirement, they still target the younger, social media-oriented demographic.

“When it comes to young kids getting into it, I think everything is so focused on marketing to the younger audience,” Brennaman said. “Just the way the apps are set up, kind of bright in a way that makes it look appealing and easy.”

Gino Donati – the founder of BetOpenly, a peer-to-peer-based sports betting platform designed to reduce the percentage of juice compared to traditional sportsbooks – credits this phenomenon to two things: Kids’ desire to obtain wealth and gambling companies want lifelong customers.

“Every kid that I know wants to get rich quick. They aren’t bad kids, they are just trying to find shortcuts in life,” Donati said. “These companies are pumping out content that appeals to kids.

“The $1 to win $1 million 30-team parlays that are lottery tickets, they’re not putting out videos on how to research a pick, they’re putting out videos on how easy it is to bet a lottery ticket.”

One of the most common sportsbook advertisements seen on both social media and traditional media is the “risk-free” bet, where a bettor’s first wager will be refunded as a way to attract new users.

Although not directly promoted by the companies hosting these wagers, Donati said seeing people win lottery ticket-type wagers on social media is one of the primary draws to join a sportsbook, especially for impressionable teenagers.

Even though kids will inevitably see content from creators like Donati, Tanner and Brennaman due to TikTok’s unpredictable algorithm, monetization comes from adult viewers.

“We don’t make money off of kids,” Donati said. “We need 18-21 year-olds but technically the kids liking the content, get the videos to reach further.”

The same sentiment goes for the betting companies doing the advertising.

That’s the kicker. The content isn’t directly promoted to underage users, but to reach a larger, more broad audience, the content has to be seen by every demographic.

So why has this become an issue in the sports betting industry? It comes down to the root of the problem: being socially acceptable.

“Kids always gamble,” Donati said. “I was literally a bookie in high school. I think what’s changed the most is it was seen as a vice back then, but now it’s socially acceptable.”

In five years, sports gambling has evolved from being viewed as a frowned-upon vice to now being socially acceptable and a regular topic in sports media.

Sports bettors, sportsbooks and social media companies haven’t exactly had time to plan for this boom in popularity, so there are bound to be some imperfections as the industry continues to grow.

“If the reason you can’t advertise cigarettes is because they are addictive, then shouldn’t you not be allowed to advertise anything that’s addictive?” Donati said.

There is no direct solution for sports betting companies to combat the issue of attracting an underage audience, but the current state of advertising and social media certainly isn’t helping the cause.

As more and more states legalize online sports betting, companies will make more money, spend more on advertising and in turn introduce more and more individuals to the concept of sports betting.

The same goes for social media. As time goes on, more people are going to join social media platforms and see this content, leading to more sports bettors in the country.

There’s not much anyone, including the sportsbooks themselves, can do to tame this emphatic boom in popularity.

The industry is growing and money is being poured into marketing schemes by the millions. Similar to anything that can be considered a “vice,” there are bound to be some loopholes and rules broken along the way.

“A lot of people want to point the finger at them (sportsbooks), but if you have a good product, you’re going to market it and make money off of it,” Brennaman said. “If other people want to do illegal stuff with your product, you could say the same thing about a beer company.”