SBJ Betting: Sportsbooks eyeing profitability to finish 2023

I came of age as a sportswriter at a time that telling the story of a game was becoming less about what happened than why it happened. That’s sort of how I think about quarterly earnings. You already know the score; up or down, met expectations or missed.My job here is to get you to the why, or at least the part of it revealed during calls with analysts. It’s Finance Friday here at SBJ Betting, coming off a week that included Q2 earnings calls from Caesars, MGM Resorts, Rush Street and, this morning, DraftKings.

Let’s see what we can get at.

Improved product helping DraftKings with profitability

We’ll start with the score on the most recent of the quarterly reports in the gambling sector: DraftKings lost $77.3 million in Q2, but beat analysts expectations thanks to higher than expected revenue of $762 million.

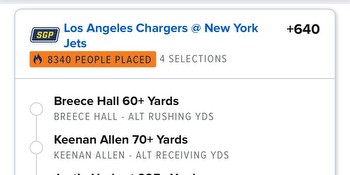

This morning’s earnings call dug into some of the why: Improved product that is attracting and engaging more bettors, particularly on more profitable in-play and parlay bet types; a better-than-expected rollover of NBA bettors into baseball; and lower promotional spending than expected.

A few takeaways:

- The continued shift toward in-play and parlay betting, and DraftKings’ improvement of its product in those areas, paid dividends as bettors who traditionally disappeared after football season increasingly hung around to sample basketball and baseball betting. “The big difference this year was the way that we were able to retain NFL players into NBA season and that has continued into baseball season as well,” DraftKings CEO Jason Robins said. “Those have both exceeded our expectations. ... If you look at past years, we typically have seen revenue decline in Q2 from Q1. We weren’t expecting this. This was the result of a huge market share (gain), year-over-year. The product is so much better than where it was last year. I feel like in the back half of the year we’re going to have the best product in the market.”

- Along with the more visible enhancements on parlays and in-play, Robins said DraftKings has gotten better at moving customers through the betting experience. “It’s a very complicated product and there are a lot of things that can create customer friction if you're not careful. A big focus for us over the last year and a half has been removing customer friction throughout the journey. That’s been a big deal. .. In (the second half of the year) we feel like we’re going to have the best product in the market.” Robins pointed to the pace of state openings, and varied regulations in those states, that created friction that DraftKings has worked to reduce now that the rush to open is behind it.

“Let’s take a look at what that has done that may have created bad experiences for customers," he said. "Flags that go off that were misfires. Or things that were actually correct but don’t actually give customers a path to resolving them. Even just better explanations. There is so much there. We look at the product and say, if you’re customer, what would be frustrating. What elements would make you feel like, I’m just going to go try somewhere else. And we try to improve that the best we can, obviously making sure that we continue to stay compliant with all regulations and laws in every jurisdiction that we operate. ... Given how many states launched and how quickly, there’s a lot of low-hanging fruit still available on that front.”

- Asked about approach to signing and renewing team and league sponsorship deals in a more cost-conscious environment, Robins said they’ll continue to evaluate them but haven’t baked any cuts into their projections for the second half of the year: “These team and league deals are a much smaller percentage of our total marketing expense than some of the other operators in the industry,” said CFO Jason Parks. “And as a general philosophy we have implemented more short duration deals to give us a chance to evaluate actual performance more frequently.”

Hornbuckle: BetMGM headed for profitability in back half of 2023

MGM Resorts pointed to several reasons it remains optimistic that its BetMGM joint venture will be profitable for the second half of this year during its earnings call on Wednesday, with CEO Bill Hornbuckle offering a frank analysis of shortcomings that have cost it ground on leaders FanDuel and DraftKings -- and reasons he believes they’re about to remedy those.

“Lower customer acquisition costs, higher margin on online sports betting, increased play by our loyal known customers -- and then all of our pre-2023 markets (are) now contribution positive,” MGM Resorts CFO Jonathan Halkyard said, rattling off key indicators of the imminent profitability that the company has guided toward. “All those things bode very well for improving profitability in the future.”

Hornbuckle focused on the recent $266 million acquisition of analytics provider Angstrom Sports by BetMGM joint venture partner Entain as an addition that can pull BetMGM’s app back even with competitors, and whose advanced data crunching capabilities have allowed them to offer in-play, parlay and prop bets that BetMGM has shied away from.

“The opportunity with Angstrom will drive more product, more parlay, more frequency and recency around bets in-game and otherwise,” Hornbuckle said. “And those are big margin businesses. That's the biggest delta between (BetMGM and leading competitors): The product offering and, more importantly, the type of products that potentially someone like a FanDuel or DraftKings will offer versus the velocity of things that we offer. We're simply going to have more high-margin bets available for customers as we deploy Angstrom.”

Caesars has first profitable quarter; CEO bullish on Vegas Super Bowl

On his company’s earnings call on Tuesday, Caesars Digital President Eric Hession pointed to improved hold percentage, targeted promotions and reduced marketing expenses as reasons behind the first profitable quarter for their digital unit since it rebranded from William Hill to Caesars Sportsbook at the start of the 2021 football season.

"We've made a lot of improvements over the last year, year and a half with respect to just the trading team getting more experienced, but also on the tech side,” Hession told analysts. “As we go forward, you will continue to see a higher percentage of customers not betting straight wagers. So whether that's an in-play or player prop or same-game parlay type wagers that generally have a higher hold percentage, that's going to contribute to the increase.”

Hession said Caesars likely will land at a hold rate of 7.5% to 8%, with Nevada coming in lower because of straight wagers placed by high-stakes bettors.

Caesars CEO Tom Reeg pointed to the long-awaited migration of its platform in the company’s home state of Nevada as fortuitously timed with a Las Vegas Super Bowl six months away. Reeg said the company expects 95% of handle in the state will be on its Liberty platform by month’s end.

“We were operating on the equivalent of a Commodore 64 computer in the old technology,” Reeg said. “Now we have the state-of-the-art Liberty app that we operate in all of our jurisdictions. This is a dramatic leap for us in Nevada. If you think about the Super Bowl happening and all of the visitors that will come to the state and our market position in the state, and now we have the app too -- that's competitive with what they've got at home, whether it's with us or somebody else. That's going to be a giant customer acquisition opportunity for us.

“This is our third NFL kickoff since we launched our digital business. In terms of how I feel heading into the season, I think we are very, very well positioned as we head in.”

Squares games, prop bets proving fruitful for BetRivers

BetRivers owner Rush Street Interactive’s Q2 earnings presentation on Wednesday included details from two tactics that it said drove users to place more parlay and prop bets.

Bringing back a proprietary squares game that it debuted during football season, BetRivers rewarded users who placed same-game parlay bets on NBA Playoff games with free random entries into an NBA squares game, which paid out bet credits of $20 to $10,000. BetRivers saw a 150% increase in NBA same-game parlay during the postseason.

For baseball season, BetRivers and sportsbook provider Kambi rolled out a player-forward “Prop Central” tab that breaks prop bets into categories such as home runs, hits and strikeouts, presented with easy-to-read odds for each player. Baseball prop bets increased 50% through the first three months of the season at BetRivers.

“We’ve put a lot of investment into really surfacing the right type of bets for the right players and the right mix of wagers for them and really make it easier for them to find the bets they really want to place,” said Rush Street Interactive CEO Richard Schwartz. “That kind of thing is going to be a real game changer, we think, in terms of improving the volume of prop bets.”

Rivers and Kambi are working to build the player prop offerings out further for football season, Schwartz said, offering live odds on TDs and other stats and expanding same game parlay options. “We’re really trying to innovate in this area,” Schwartz said, “and ensure that we get those volumes on the player bet on the bet types that we’re interested in.”

Charges in Iowa highlight need for more player education

Charges filed this week alleging that Iowa State QB Hunter Dekkers, now-Broncos DL Enyi Uwazurike (formerly at Iowa State) and four other athletes concealed their identities while betting on games involving their schools or teams reminded me of a conversation I had recently with US Integrity CEO Matt Holt.

We were talking about whether college and pro players fully understood the rules and laws around whether they can bet, what they can bet on, and where they can do it when he brought up a larger concern about how they were doing it. He pointed out that players needed to be made aware, or reminded, that betting on an account registered to someone else to avoid getting caught by a school or league could open them up to criminal charges -- and that it’s easy to get caught.

The geolocation required to place a legal bet tells sportsbooks, regulators and integrity monitors precisely where you were when you wagered. “Some of these guys think they’re bulletproof because they have someone else -- their girlfriend, their wife, their buddy -- sign up for the account,” Holt said. “But then when all the logins happen from the team facility at practice, well, your girlfriend isn’t at practice. Your buddy isn’t part of the team. The only people in the stadium is the team. And now, not only can they trace it back to you -- because it’s your girlfriend and everyone knows who that is -- but you can get in trouble for using someone else’s account, which is against the law in some states.

This isn’t like sharing Netflix passwords.

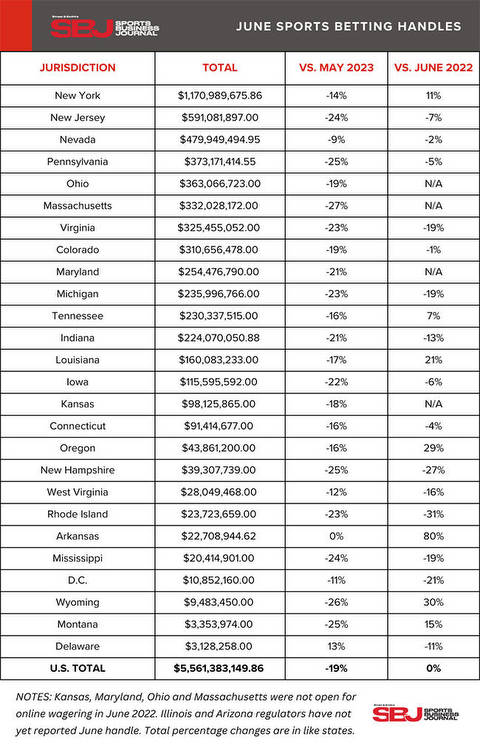

Sports betting handle across U.S. in June tracking at same level as in 2022

The Arizona Department of Gaming’s report of a $451.7 million in sportsbook handle in May enables us to close the books on that month, with U.S. legal handle coming in at $8.131 billion, down 13% from April, but up 2% over May 2022 in like states.

That’s the fourth consecutive month of handle growth of 2% or less in like states. April also was up 2% against the previous April, while March was up 1% and February was down 1%. January was up 5% compared to January 2022.

Keep in mind that this is handle, not revenue. Sportsbooks are getting better at squeezing more money out of the same handle, increasing the mix of higher profit bets like parlays and reducing customer acquisition spending as they push to report profitability. But the handle flattening does hint that the aggressive push to smoke out potential bettors in newly opened states may cause markets to mature more quickly.

With Illinois and Arizona still to report, June is tracking in a dead heat with June 2022.

Here’s that look at June:

ICYMI: Check out SBJ Live discussion on sports betting

We had a terrific discussion about all things sports betting -- okay, not enough time for all things, but we covered a lot in an hour -- last week on our SBJ Live show, which you can now watch here.

Big thanks to Scott Warfield of the PGA Tour, Eric Foote of Vig Sports consulting and Chris Grove of Acies Investments for joining me and providing lots of insights.

- Snapscreen Inc. is entering into a strategic partnership with global gambling advisory firm SCCG Management to aid in the distribution of its live-betting video recognition technology, SnapOdds, reports SBJ's Rob Schaefer.

![Sports betting companies battle for customers as NFL season kicks off [Video]](/img/di/sports-betting-companies-battle-for-customers-as-nfl-season-kicks-off-video-1.jpg)