Sports Gambling & Media: The Webinar

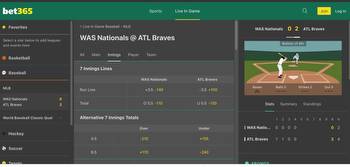

2022 was a transformative year for the sports gambling industry. The number of states where it’s legal grew by five, including gambling heavyweight New York, leading to record amounts wagered across the country. Now VIP+ has updated its “Sports Gambling & Media” special report for the third time, with a focus on what the rise of mobile sports betting in particular means for media partners.

Adding to our comprehensive coverage of the emerging market, VIP+ held a webinar with industry experts from across the media landscape. Joining senior media analyst Gavin Bridge to discuss the opportunities sports gambling presents media partners were Chris Bevilacqua, CEO at Simplebet; Raph Poplock, SVP of Business Development, Bleacher Report; Liam Roecklein, SVP of Content, PointsBet; and Jason Steeg, president of ECI Research, the company that designed VIP+’s sports gambling survey, which was fielded by its parent company CRG Global.

One of the key topics discussed was what is fueling sports betting’s rise. Even with the 2022 total not complete, it is up considerably ($38.2 billion, or 75%) versus 2021, and this can’t all be attributed to New York (January), Louisiana (January), Arkansas (March), Kansas (September) and Maryland (November) legalizing operations last year.

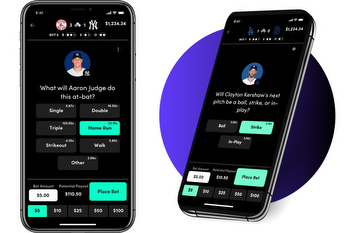

PointsBet’s Roecklein noted that the rise in wagers is a combination of additional states legalizing but also betting behavior increasing in states where the practice has been legal for some time. Bleacher Report’s Poplock added that the sports bet industry has done a good job of innovating new betting markets based on user behavior. Bleacher Report has noticed a trend in younger viewers not watching full games so brought out a line of quick-resolving bets that have seen upticks in engagement and wagering with their sportsbook partners.

While winning money is the No. 1 reason for betting on sports, over half of bettors said in the CRG Global/VIP+ poll that doing so was entertaining. The panel weighed in on why, with Bevilacqua and Roecklein both noting that gambling is becoming entwined with sports content on TV — such as PointsBet’s onscreen partnership with NBCUniversal — and is driving an uptick in casual bettors placing simple wagers.

These casual gamblers often graduate to putting more complex bets, but there is also a social aspect behind the entertainment factor, as people bet with their friends and communicate with them around their status.

VIP+ has previously noted the positive relationship between betting and increased viewership of games, but Bevilacqua gave a very interesting example of how this works in real-time. Simplebet’s data showed that the aftermath of the opening game of the NFL’s 2022 season, which was followed by a blowout baseball game between two teams with nothing to play for, saw many NFL bettors getting involved in the MLB tie to the extent that it had the greatest total wagers placed across Simplebet for any baseball game in 2022.

The CRG Global/VIP+ study found that betting results in new fans being made of teams, with over a quarter of gamblers reporting this. When asked why, ECI Research’s Steeg wasn’t surprised by this but added that the phenomenon will extend to people becoming fans of specific players. This was something PointBet’s Roecklein said occurred during the World Cup, where Messi fans ultimately converted to Argentina fans during the successful tournament run and grew betting activity.

VIP+’s research with CRG Global found that people who have an active bet during a blowout game are much less likely to have their attention drop in a one-sided blowout game, maintaining their engagement.

Simplebet’s business is geared to in-game bets, and CEO Bevilacqua noted that in a recent NFL Wild Card game, which happened to be a blowout, they saw more bets placed in the second half, when blowout status had been reached, than in the first when the game was competitive. This demonstrates how blowout games can still be engaging for viewers but also how microbets can drive up that interest.

Watch the full webinar above to hear how the latency in TV/streaming impacts betting behavior, how additional media is being created to fill the content needs of sports bettors, who is betting, whether we can expect closer integration between sports on TV and betting, the seasonality of betting and lots more detail on the issues covered above.

And of course, click below and dive into our expansive special report ...