Sports betting is soaring in Mass. one year after introduction

Massachusetts House Speaker Ron Mariano is still not happy about the $100 he lost on the bet he placed with DraftKings last March 10, the first day online sports betting became legal in the state.

But even though the Red Sox fell just one win short of the speaker cashing in on the “over” of 78.5 wins, he is buoyed by the bet’s flip side.

The $20 in taxes DraftKings paid to the state on the bet was one drop that helped fill a much-bigger-than-expected bucket of sports betting tax revenue. Massachusetts has collected more than $108 million in the first year since it became the 36th state to legalize sports wagering.

“It’s been hugely successful, much bigger than we anticipated,” said Mariano. “I was a firm believer that there was a really strong market out there and that we were foolish not to take advantage of it.”

The state has yet to tabulate the long-term social costs incurred from problem sports gambling, one of a handful of ongoing concerns of the Massachusetts Gaming Commission, the regulatory arm charged with the rollout and oversight of sports betting.

What is certain is how quickly sports betting has taken a deep hold in the state.

Taxes generated are about twice as much as the initial estimates of $30 million to $60 million a year.

And while those taxes represent a slim slice of the $39 billion-plus the state collected in fiscal year 2023, they come at a time when the state’s actual tax collections keep lagging behind projections.

Every bet helps, and after nearly a full year of data, a fuller picture is emerging of the Massachusetts sports betting landscape.

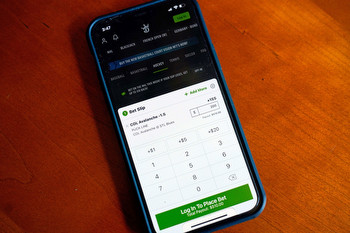

Retail sports betting at the state’s three casinos began last Jan. 31, but 97 percent of the money bet on sports is bet over the phone, especially using the app of Boston-based DraftKings, where one out of every two wagered dollars is bet.

Since its launch on March 10, 2023, online sports betting has taken in $5.45 billion of the $5.6 billion bet (the “handle”),and that’s before February’s numbers, which include Super Bowl betting, are revealed March 15.

According to the American Gaming Association, the $4.82 billion online handle generated in Massachusetts in the first 10 months ranked seventh in the country and was the third-highest of any state in its first 10 months, exceeded only by New York ($13 billion) and Ohio ($5.8 billion).

In those 10 months, the average Massachusetts online bettor wagered about $91 a month, seventh in the country per capita.

New Yorkers bet more, $106 a month, but Massachusetts bettors far outpaced their other neighbors: New Hampshire ($52), Connecticut ($51), and Rhode Island ($32).

“Massachusetts has seen one of the strongest sports betting launches among states that have legalized wagering since 2018,” said Cate DeBaun, AGA vice president of strategic communications and responsibility, in an email.

DraftKings’s overall 50 percent market share in Massachusetts exceeds its national market share of 34 percent over the last three months of last year, when FanDuel led at nearly 40 percent, according to Eilers & Krajcik Gaming Estimates.

In the first 11 months, DraftKings settled $2.78 billion in wagers — 51 percent of online wagers in the state and 49 percent of total sports betting — with FanDuel at $1.6 billion, 29 percent of the online handle.

DraftKings was responsible for 49.4 percent of taxes collected, FanDuel 31.7 percent; online operators are taxed at a 20 percent rate, casinos at 15 percent.

“We anticipated strong market share in our home state but have also fine-tuned our online sports betting launch playbook,” said Stephanie Sherman, DraftKings chief marketing officer, in an email. “Each state launch is different and we take an analytical approach to optimize our go-to market but for competitive reasons I cannot divulge more on our rollout strategy.”

The cost of customer acquisition and retention is no different in Massachusetts than in other states, said Sherman, but Massachusetts sports bettors do bet differently, at least with DraftKings.

In a nation where the NFL commands most of the betting action, Massachusetts DraftKings bettors place most of their bets on the Celtics and the NBA. The NFL is the second-most bet league, followed by MLB, college basketball, and college football.

As for most bet teams, the Patriots do not show up in DraftKings’s top five by handle (Celtics, Bruins, Kansas City Chiefs, Red Sox, San Francisco 49ers) or number of bets (Celtics, Bruins, Red Sox, Atlanta Braves, Tampa Bay Rays).

Trailing DraftKings and FanDuel in the state online sports betting market are BetMGM, ESPN BET (formerly Barstool Sports), Caesars, and Fanatics, in that order.

Two operators are closing up shop, Betr and WynnBET, with one, Bally Bet, staying on the sidelines despite MGC approval.

There have been hiccups, for sure, among all the online sports operators as well as at the state’s three casino sportsbooks. The majority involved glitches that allowed bets to be taken on Massachusetts college teams — a no-no unless those teams are playing in an NCAA tournament — with a few pending cases of allowing single-player collegiate prop bets, also not allowed.

There also were instances of advertising that wandered into “risk-free” territory, with the MGC swiftly ordering those ads to be halted.

DraftKings has had its share of problems conforming to the letter of Massachusetts law. It offered bets on a lower-level tennis circuit that is not included in the MGC’s catalog of bettable sports and, more seriously, the MGC is addressing allegations of a DraftKings glitch allowing Massachusetts sports betting accounts to be funded by out-of-state credit cards. Using credit cards to make deposits in Massachusetts accounts is prohibited.

Overall, MGC commissioner Eileen O’Brien thought the rollout of “both the brick-and-mortar and the online went remarkably smoothly.”

The MGC remains vigilant in keeping advertising on TV, radio, billboards, and even trash cans in check.

Mariano is 0 for 3 in sports betting, having also lost the two $50 bets he placed last Jan. 31, one each on the Celtics and Bruins to win a championship.

“I thought the Bruins were a lock,” said Mariano.